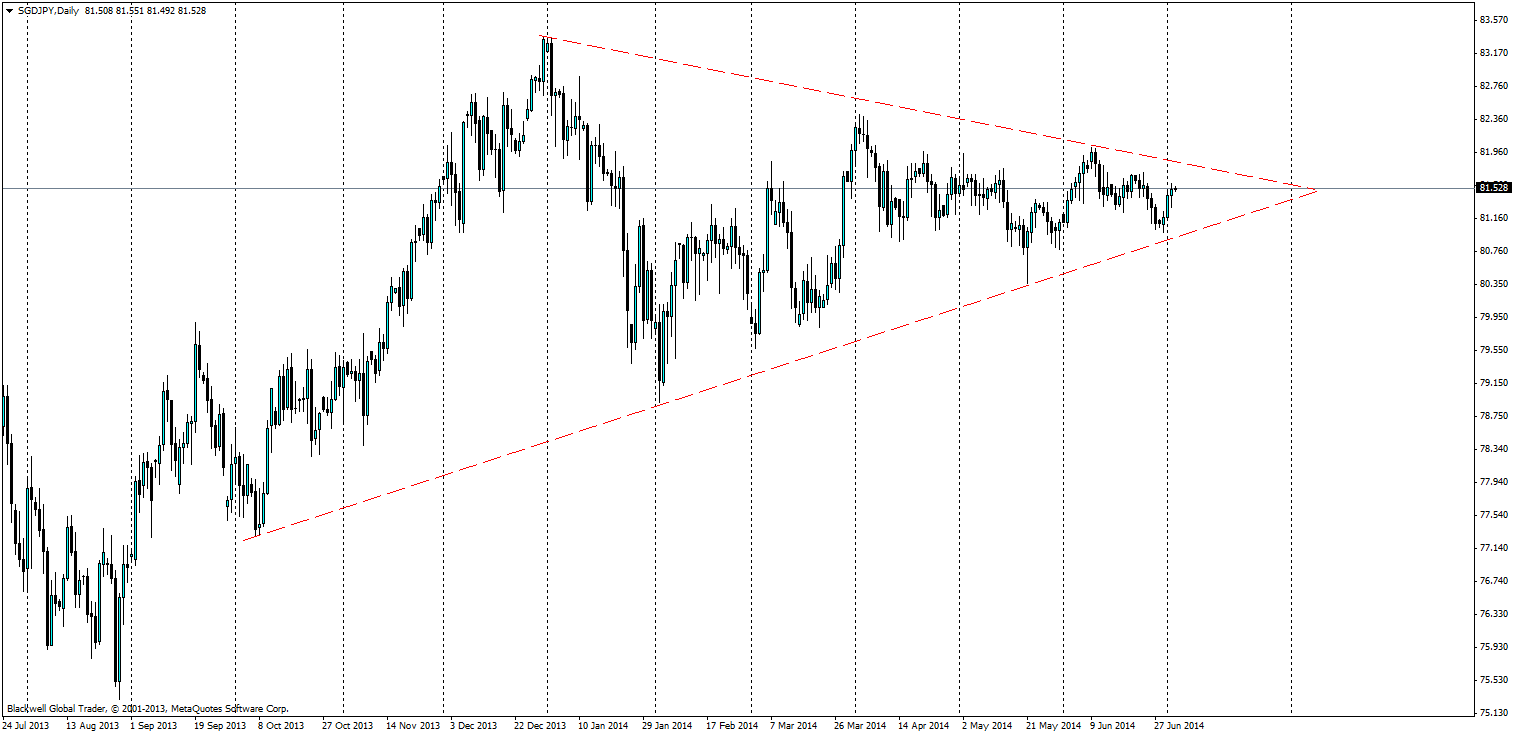

Source: Blackwell Trader (SGD/JPY, D1)

The Singapore dollar seems to have an affinity for technicals, especially when trading against various other currencies bar the USD. So far the SGD/JPY has been an interesting pair to watch with an ascending triangle which has formed, market participants have so far been a little coy when it comes to the Japanese Yen as of late.

However, an ascending triangle provides plenty of opportunity; especially when the SGD has so far been riding heavily on the charts.

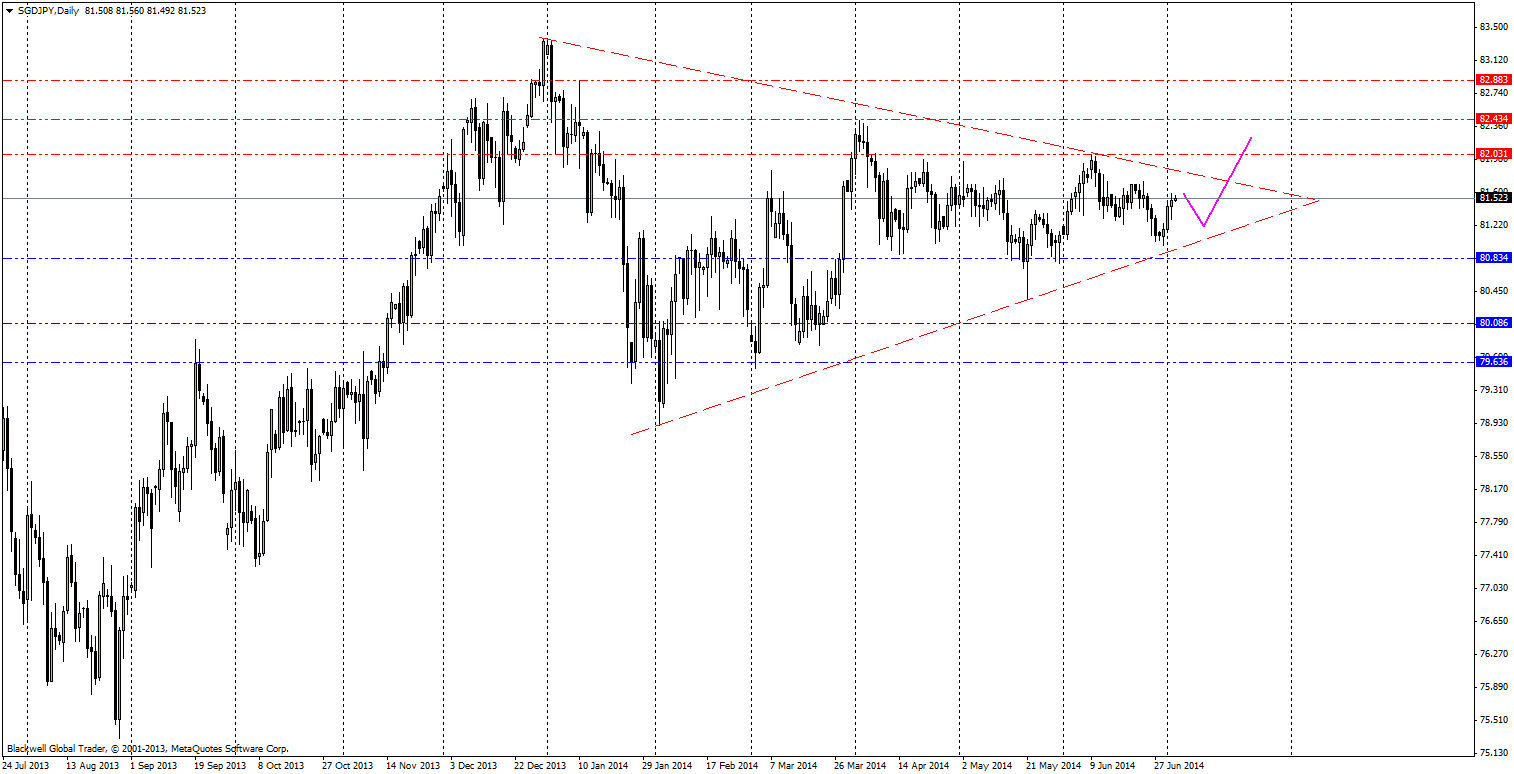

Source: Blackwell Trader (SGDJPY, D1)

Currently I believe that we will see another consolidation wave lower before we see a breakout of the current triangle. Certain levels will be key here as I believe it will break higher, and resistance levels will be found at 82.031, 82.434 and 82.883; with 82.434 likely to act as heavy resistance in the market.

In the event that the market does shift lower, support levels can be found at 80.834, 80.086 and 79.636. Such a break out lower would signal major bearish action and lead to a much more aggressive market stance from myself when it comes to this cross.

Overall, any SGD pair tends to be very solid technically and this is a good example of just that. A nice ascending triangle is generally a bullish signal to the markets, but we will have to wait for this one to break out to catch a solid extension. In the meantime though, the current triangle still also offers short term opportunities as the pair trades between the walls and uses it as dynamic resistance and support.