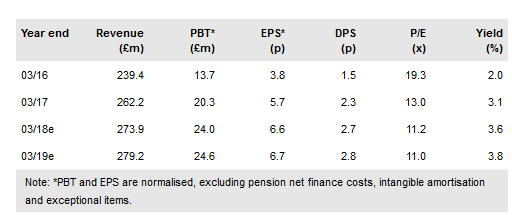

Strong H118 results and positive order book development cause us to raise estimates, especially for the current year with better dividend prospects also. UK economic uncertainty will provide challenges but we believe that Severfield-Rowen's (LON:SFR) sector diversity and some pipeline project opportunities should allow the company to continue to grow. Further order book gains and the application of surplus cash balances (via investment or distribution) can be catalysts for further share price recovery.

Strong H118 performance

Management had previously flagged a stronger H1 weighting in the current year and H118 results (21 November) showed a good increase in revenue (+16%), around three-quarters of which was volume-driven. Underlying margin performance was very strong with good progress on ongoing and completed projects. The UK order book has increased versus last reported and there appear to be some reasonable pipeline opportunities also. JV and associate companies (JSW Severfield Structures, India and CMF, respectively) both made positive profit contributions in the period. The H1 dividend was increased by 29% y-o-y.

To read the entire report Please click on the pdf File Below: