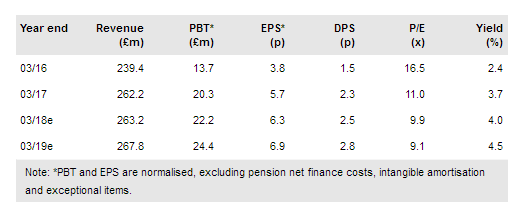

Severfield (LON:SFR) continues to trade in line with existing expectations though adverse sector sentiment has weighed on the company’s share price. There is a healthy and normal level of forward order cover and we believe that the project pipeline is likely to contain some good new project prospects. Overall, the AGM update provided reassurance for wary investors and, in our view, encouragement for potential new ones.

Positive order book interpretations

Severfield’s AGM update noted the likelihood of a greater H1, and implicitly more even full year, weighting to FY18 results compared to the prior year (FY17 EBIT H1:H2, 42:58). We assume that this reflects the pattern of projects at or nearing completion and is consistent with higher activity levels seen last year. The UK order book value is slightly below the last reported level at £221m. (This provides forward cover for all four UK fabrication facilities, naturally longer for some reflecting underlying project characteristics.) As well as the cycle through of orders this could be interpreted as a signal of slowing markets and/or more protracted tender processes.

On the other hand, it could also signify a reaffirmation of Severfield’s ongoing project selectivity, possibly with a view to securing visible pipeline opportunities in the context of available capacity. The company’s bid conversion rate is understood to have been very consistent and stable in the year to date. We believe that the pipeline of larger UK project prospects is significant and spread across a number of segments addressed.

To read the entire report please click on the pdf file below: