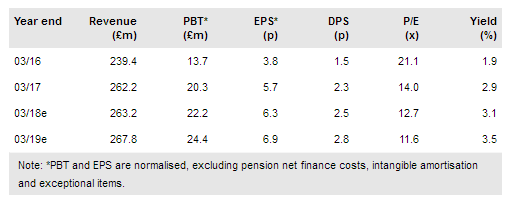

Good momentum is apparent in Severfield-Rowen’s (LON:SFR) results, with healthy progress in revenue and margins in the UK and a profit contribution from the Indian JV. Our estimates now expect a sustained JV profit contribution (previously neutral) and, with unchanged UK expectations, Severfield is on track to double PBT between FY16 and FY20. All in all, we see a clear strategy that is being well executed against visible financial targets.

Good progress on several fronts

A c 50%+ uplift in full year earnings and dividends and further growth in group cash balances were the headline financial highlights. Underlying EBIT and a maiden full year profit contribution from the Indian JV were both ahead of our expectations, partly offset by higher interest and share-based payments, leaving group PBT slightly better than anticipated overall. There was solid operational performance in the UK – with the highest H2 activity levels for seven years – and in India, which saw both revenue and margin gains y-o-y. At the same time, there is clear evidence of investment in equipment, processes, systems and people across the business, which indicates that this progress and future prospects are well-founded.

To read the entire report Please click on the pdf File Below