Here are seven ETFs of interest and a few thoughts on each.

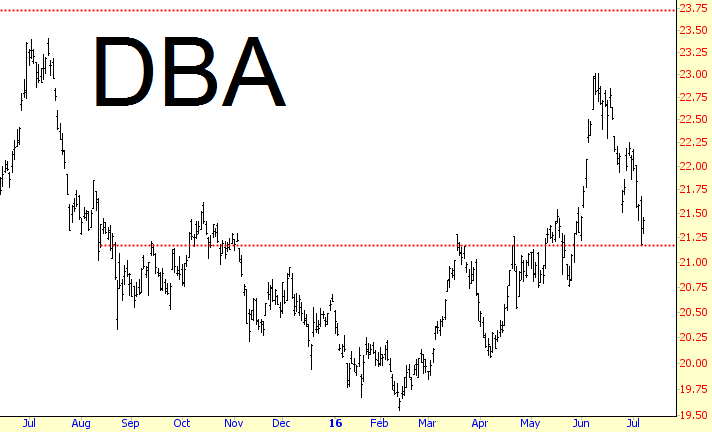

First up is the PowerShares DB Agriculture ETF (NYSE:DBA), which has a decent basing pattern. This isn’t very heavily traded, and it isn’t a big percentage mover, but it also isn’t prone to shocking moves, either.

The triple-bearish Direxion Daily Energy Bear 3X Shares ETF (NYSE:ERY), shown below, looks like it’s starting to gain a bit of strength after having withered away most of the year.

The Guggenheim CurrencyShares Euro ETF (NYSE:FXE) is following its channels quite nicely, and it seems more prone to weakness than strength at present levels.

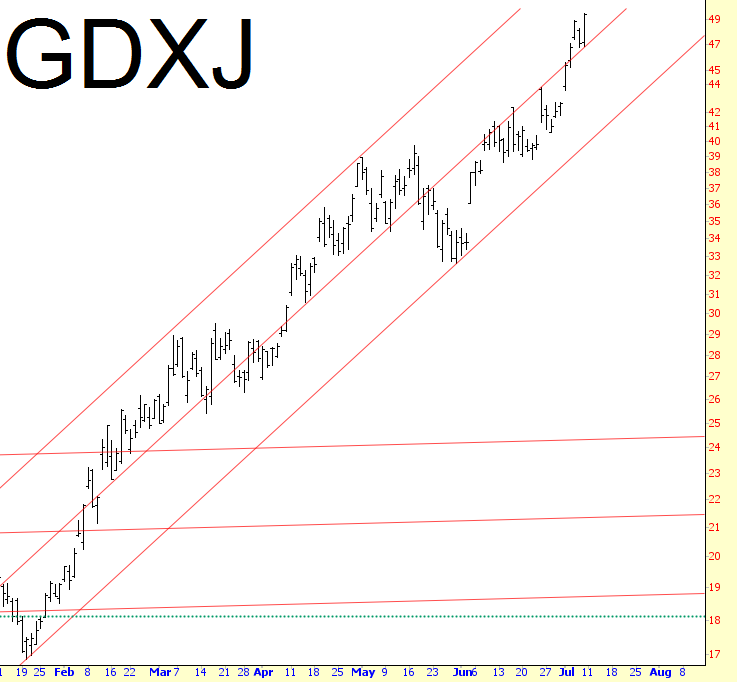

The standout for 2016 of course is VanEck Vectors Junior Gold Miners (NYSE:GDXJ). I’ve drawn a channel with a midline for the junior miners, and although it’s rather lofty right now, it seems to me a trip into the mid-50s seems totally plausible before it backs off.

Of course, the world of equity shorts overall has continued to be terrible, and the Ranger Equity Bear (NYSE:HDGE) fund illustrates this. It was great being a bear for the first few weeks of the year, but whammo, and that all ended. Since then, there have been about four half-hearted attempts for the market to move lower, but every one failed. Thus, this fund remains below its 2015 close (marked with the red line).

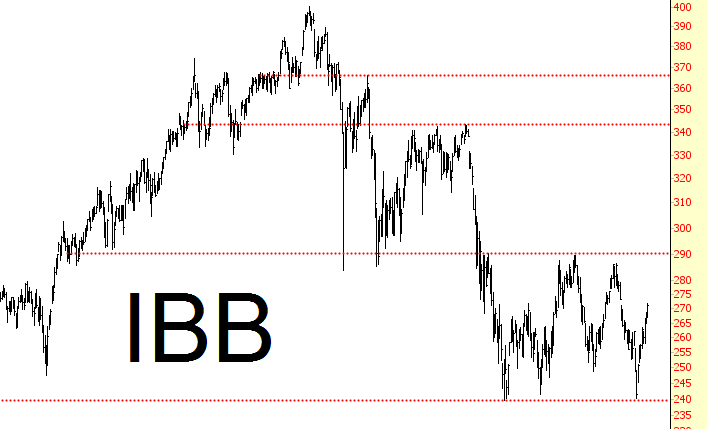

iShares Nasdaq Biotechnology (NASDAQ:IBB) has been recovering some lately (including wipeouts like VRX), but it looks to me like nothing more than another “lower high” being painted out.

Lastly, there’s iShares Silver (NYSE:SLV), which has been pretty much dynamite all year long, with a couple of bouts of weakness to shake out the fearful. It actually completed its measured move already, calculated on the basing pattern, but at this stage I’m not going to sell precious metals short (either literally or figuratively).