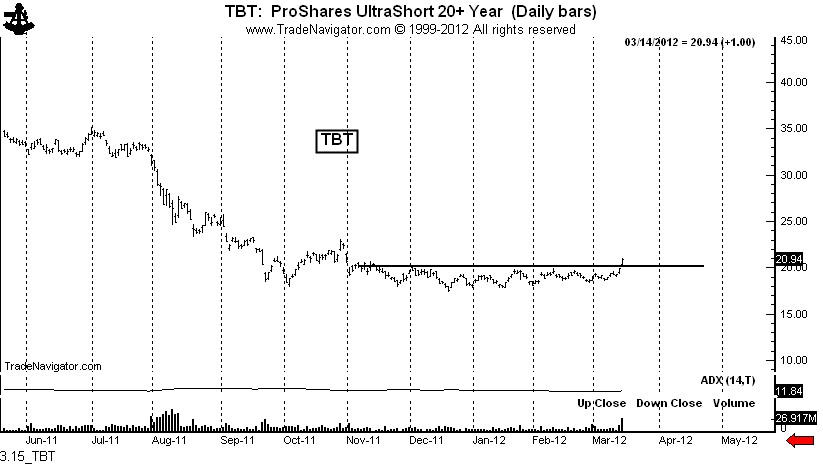

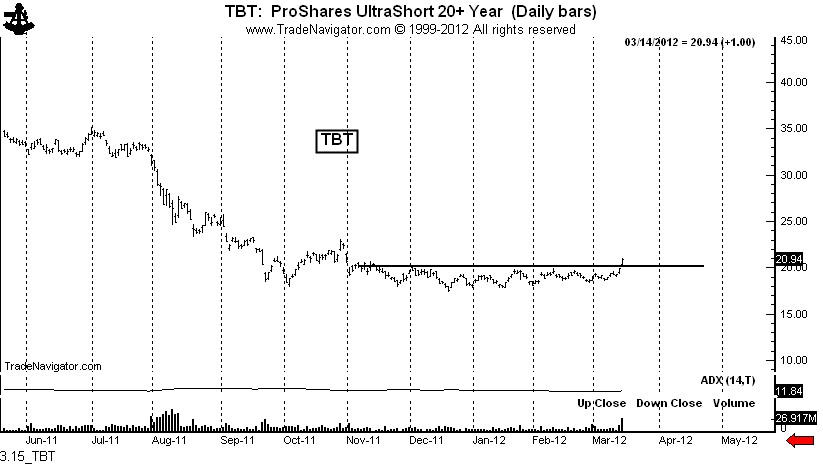

Thirty-year T-Bonds futures are poised to make a new 7-month low

The practical implication of this is that every purchaser of 30-yr Bonds dating back to early August will be have a loss in the position. Analysts that have fully bitten into the ZIRP (Zero Interest Rate Policy) apple and come under the magic spell of Timmy the Wizard may say that the Fed can control rates forever — and that a meaningful advance in Treasury yields is not possible — but investor psychology is a constant throughout history and investors do not like losses on “sure bet” investments.

The QE3..4..5..6..7 fans may also claim that the Fed can control rates by just printing more money and buying its own debt forever. Really? I mean, really? Folks who buy into this logic must believe that government actually knows what it is doing. I am not about to bet my net worth on the competence of federal elected officials and bureaucrats. Frankly, 20 years from now I think history will be very cruel to uncle Ben and little Timmy.

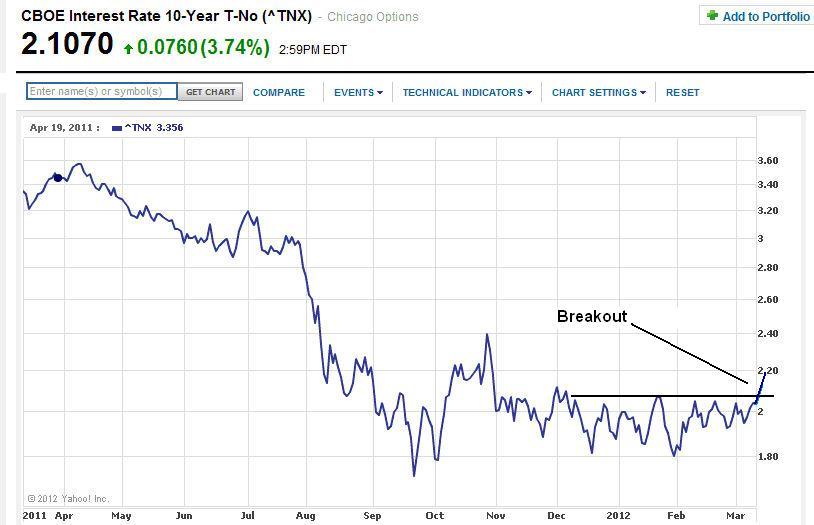

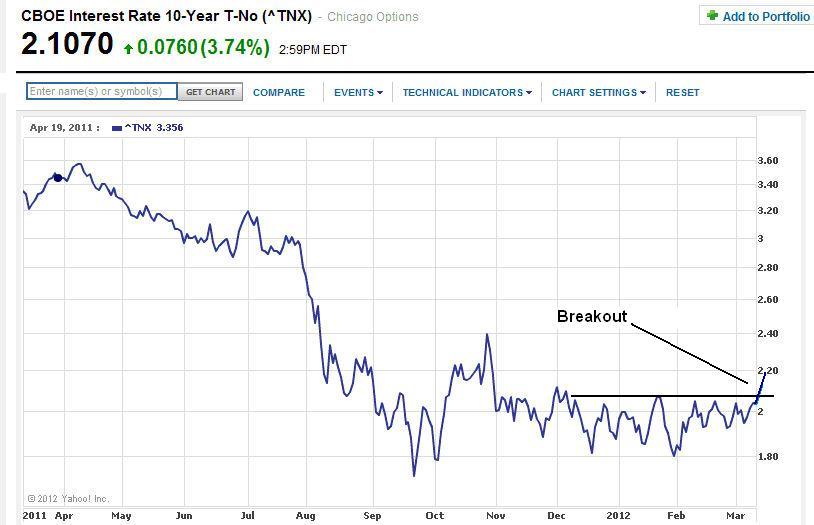

Chances are that the 10-Yr. Note will not get much above 2.40% to 2.50% on this move. I will be out of my positions before we hit this level. Yet, the point I make is that the grand 32-year cycle of lower rates may have ended — that the low tick in rates is in place. And, as a trader, this is very valuable information. The only reason the low tick might not be in place would be a severe deflationary period — and if this occurs you and I all have more serious problems than my inability to pick the bottom in rates.

The practical implication of this is that every purchaser of 30-yr Bonds dating back to early August will be have a loss in the position. Analysts that have fully bitten into the ZIRP (Zero Interest Rate Policy) apple and come under the magic spell of Timmy the Wizard may say that the Fed can control rates forever — and that a meaningful advance in Treasury yields is not possible — but investor psychology is a constant throughout history and investors do not like losses on “sure bet” investments.

The QE3..4..5..6..7 fans may also claim that the Fed can control rates by just printing more money and buying its own debt forever. Really? I mean, really? Folks who buy into this logic must believe that government actually knows what it is doing. I am not about to bet my net worth on the competence of federal elected officials and bureaucrats. Frankly, 20 years from now I think history will be very cruel to uncle Ben and little Timmy.

Chances are that the 10-Yr. Note will not get much above 2.40% to 2.50% on this move. I will be out of my positions before we hit this level. Yet, the point I make is that the grand 32-year cycle of lower rates may have ended — that the low tick in rates is in place. And, as a trader, this is very valuable information. The only reason the low tick might not be in place would be a severe deflationary period — and if this occurs you and I all have more serious problems than my inability to pick the bottom in rates.