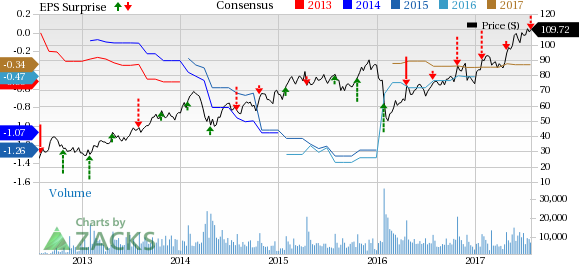

ServiceNow Inc (NYSE:NOW) reported loss of 25 cents per share in second-quarter 2017, which was wider than the Zacks Consensus Estimate of a loss of 18 cents. Excluding stock-based compensation, earnings of 22 cents per share surged 46.7% from the year-ago quarter.

Revenues of almost $478.5 million surged 40.2% year over year and easily surpassed the Zacks Consensus Estimate of $463 million. Management had guided 33–34% year-over-year growth in revenues to the range of $469–$474 million.

Notably, ServiceNow has outperformed the industry on a year-to-date basis. While the industry gained 22.8%, the stock returned 47.6% over the same time frame.

Quarter Details

Subscription revenues (87.2% of total revenue) surged 43.5% (adjusted for constant currency) from the year-ago quarter to $417.1 million. Revenues were forecast between $409 and $413 million, representing 39–40% year-over-year growth.

Professional services and other revenues increased 21.4% to $61.5 million. Revenues were expected to grow 14%–17%.

Total billings surged 35% year over year to $504.9 million. This was less than the guided range of 36-37% year-over-year growth. Subscription billings of $456.6 million represented 37% year-over-year growth, while Professional services and other billings increased 15% to $48.3 million. Both were a bit lower than guided.

Management noted that during the quarter, Information Technology Service Management (ITSM) was one of the factors driving the company’s top line. The quarter witnessed a renewal rate of 97.7%

Management stated 58% of the quarter’s net new annual contract value (ACV) came outside of ITSM compared with 40% from the year-ago quarter. Launch of the company’s newest HR product saw a significant customer acquisition in the second quarter with net new ACV of almost $3.5 million. The company’s Customer Service Management product is also gaining traction. ServiceNow also made its platform Jakarta available to all at the end of the quarter, incorporating intelligent automation into the platform and adding machine learning capabilities to all the relevant products.

Adjusted gross margin expanded 200 basis points (bps) year over year to 78%. Adjusted operating income increased 91.1% from the year-ago quarter to $65.3 million. As a result, non-GAAP operating margin increased 400 bps year on year to 14%.

ServiceNow generated free cash flow of $92.9 million (20% of revenues) compared with $154.2 million (37% of revenues) in the first quarter.

Guidance

For third-quarter 2017, non-GAAP total revenue is expected to grow 36–37% year over year to the range of $485–$490 million. Subscription revenues are forecast between $440 and $444 million, representing 38–39% year-over-year growth. Professional services and other revenues are expected to grow 16%–19% to $45–$46 million.

Total billings are anticipated to grow 34–35% year over year and be in the $540–$545 million range.

Subscription billings are projected between $491 million and $495 million, representing 35–36% year-over-year growth. Professional services and other billings are expected to grow 18–20% in the range of $49–$50 million.

Operating margin is anticipated to be 17%.

For full-year 2017, total revenue is forecast between $1.903 and $1.913 billion (up from previous guidance of $1.886 and $1.906 billion), representing 37–38% year-over-year growth. Subscription revenues are expected to grow 40–41%, while Professional services and other revenues are anticipated to grow 14–15%.

Total billings are anticipated between $2.271 billion and $2.281 billion (down from $2.272 billion and $2.292 billion), representing 34–35% year-over-year growth. Subscription billings are expected to grow 37% year over year, while Professional services and other billings are expected to grow 14–15%.

Subscription and Professional services & other gross margin are expected to be 84% and 15%, respectively. Total gross margin and operating margin guidance was maintained at 77% and 16%, respectively.

Zacks Rank & Stocks to Consider

ServiceNow currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the space include Applied Optoelectronics, Inc. (NASDAQ:AAOI) , Ciena Corporation (NYSE:CIEN) and Cypress Semiconductor Corporation (NASDAQ:CY) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rates for Applied Optoelectronics, Ciena and Cypress Semiconductor are projected to be 18.8%, 15.7% and 11.1%, respectively.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

See these stocks now>>

ServiceNow, Inc. (NOW): Free Stock Analysis Report

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Ciena Corporation (CIEN): Free Stock Analysis Report

Original post

Zacks Investment Research