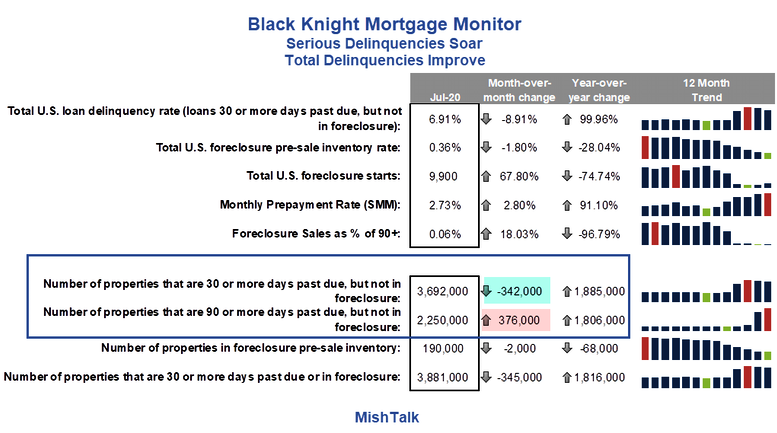

Early stage mortgage delinquencies improved in July, but serious delinquencies are another matter.

Good News and Bad News

The Black Knight (NYSE:BKI) Mortgage Monitor for July has a bit of good news and bad.

The Good News

- Mortgage delinquencies continued to improve in July, falling 9% from June, with more than 340,000 fewer past-due mortgages than the month prior.

- Early-stage delinquencies (30 days past due) have fallen below their pre-pandemic norms. This is a good sign that – at least for the time being – the inflow of new COVID-19-related delinquencies has subsided.

- Though foreclosure starts ticked up slightly for the month, COVID-19 foreclosure moratoriums are keeping both foreclosure starts and completions at record lows.

- Driven by record-low mortgage interest rates, prepayment activity edged slightly higher in July, hitting its highest point since early 2004.

The Bad News

- Some 376,000 homeowners became 90 or more days past due in July.

- Serious delinquencies were up 20% from June and are now the highest they’ve been since early 2010.

- In total, serious delinquencies are now 1.8 million over pre-pandemic levels.

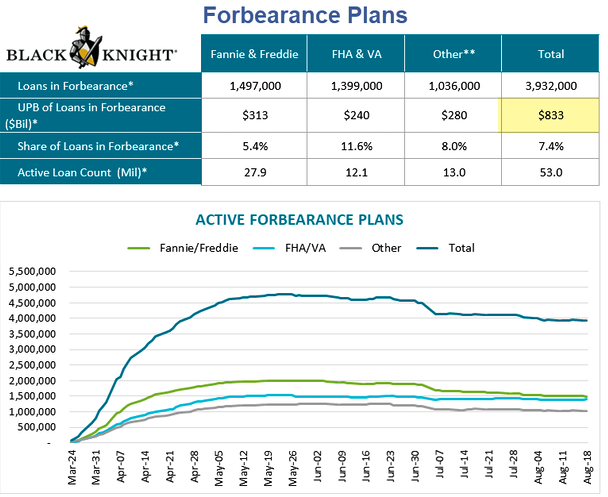

Forbearance Plans

* Figures from Black Knight's McDash dataset extrapolated to estimate the full market

** Other categories include portfolios, private label, and other other entities

Forbearance Stats

- According to Black Knight’s McDash Flash data set, the number of mortgages in active forbearance remained flat over the past week, with a 15,000 reduction among GSE mortgages offset by a 5K raise in FHA forbearances and a 10K increase among portfolio/PLS held loans.

- As of Aug. 18, 3.9 million homeowners remain in active forbearance, representing 7.4% of all active mortgages, unchanged from last week. Together, they represent $833 billion in unpaid principal.

- Some 5.4% of all GSE-backed loans and 11.6% of all FHA/VA loans are currently in forbearance plans. Another 8% of loans in private label securities or banks’ portfolios are also in forbearance.

The number of people in forbearance plans has stabilized, but the total amount has risen to $833 billion.

Looking Ahead

The weekly $600 pandemic benefit checks stopped due to congressional bickering on July 25.

We are now in the fourth week of missed weekly checks.

This will send the delinquency and forbearance numbers higher at some point.

For discussion of the latest unemployment claims and those collecting pandemic benefits, please see Unemployment Claims are Back Above the One Million Mark.

Also note the IRS Projects Millions of Jobs Will Vanish for Years.