Investing.com’s stocks of the week

The September euro is trading lower overnight as investors continue to price in the expected interest rate cut later in the session. Speculation is the European Central Bank will cut its benchmark interest rate by 25 basis points to .75%. There are a small number of traders looking for a 50 basis point reduction. Based on the consensus, however, a reduction of this size would be a surprise and almost certainly fuel a round of heavy selling pressure.

Since the news has probably been factored into the euro, after an initial move lower, the market may actually stabilize and reverse course. This action will be caused by profit-taking and position squaring ahead of Friday’s U.S. Non-Farm Payrolls report.

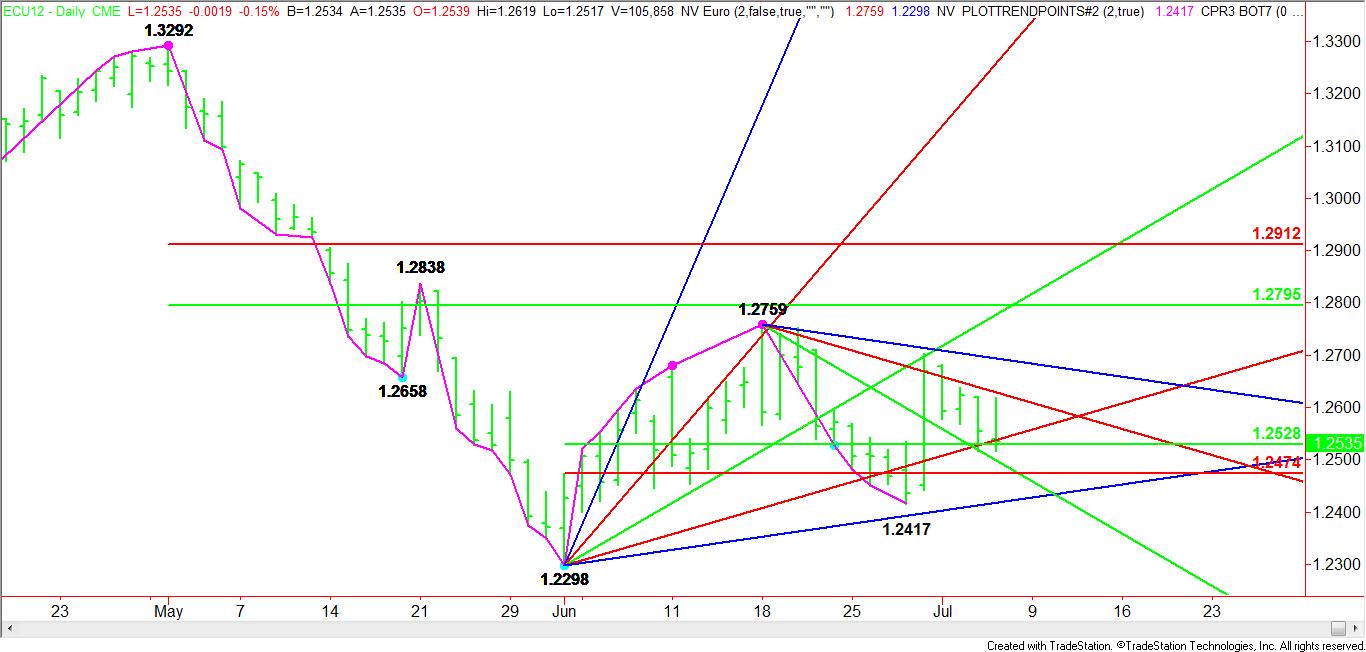

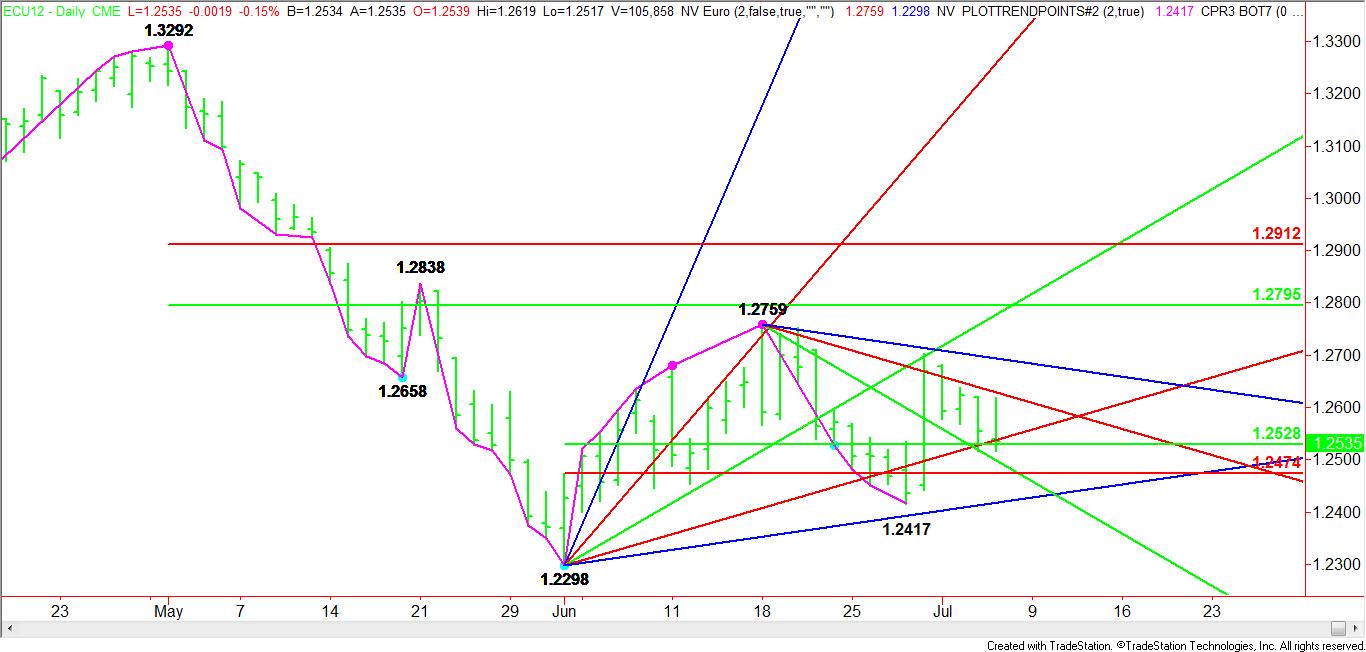

Technically, the main trend remains down on the daily chart. It will turn up on a move through 1.2759. Currently, the September Euro is straddling the 50% price of the 1.2298 to 1.2759 range. This price is 1.2528. This is basically “balancing action”. Bullish traders may try to build a secondary higher bottom between the 50% and 61.8% price levels at 1.2528 to 1.2474 in anticipation of a weak U.S. employment number.

Additional support is being provided by an uptrending Gann angle at 1.2538. If the retracement zone fails to hold then the Euro may break into another uptrending Gann angle at 1.2418. A move to this level will mean that the entire rally which took place after the European Summit has been wiped out. Resistance is at 1.2629 today.

In summary, look for the ECB to provide some stimulus this morning with a quarter-point interest rate cut. Any additional stimulus will put pressure on the Euro. Two surprises could take place today. Firstly, the central bank may refrain from cutting rates and secondly, it may reduce by more than 25 basis points.

Since the rate cut has been priced in, traders should look for an intra-day reversal due to profit-taking and position squaring ahead of tomorrow’s U.S. jobs report.

Since the news has probably been factored into the euro, after an initial move lower, the market may actually stabilize and reverse course. This action will be caused by profit-taking and position squaring ahead of Friday’s U.S. Non-Farm Payrolls report.

Technically, the main trend remains down on the daily chart. It will turn up on a move through 1.2759. Currently, the September Euro is straddling the 50% price of the 1.2298 to 1.2759 range. This price is 1.2528. This is basically “balancing action”. Bullish traders may try to build a secondary higher bottom between the 50% and 61.8% price levels at 1.2528 to 1.2474 in anticipation of a weak U.S. employment number.

Additional support is being provided by an uptrending Gann angle at 1.2538. If the retracement zone fails to hold then the Euro may break into another uptrending Gann angle at 1.2418. A move to this level will mean that the entire rally which took place after the European Summit has been wiped out. Resistance is at 1.2629 today.

In summary, look for the ECB to provide some stimulus this morning with a quarter-point interest rate cut. Any additional stimulus will put pressure on the Euro. Two surprises could take place today. Firstly, the central bank may refrain from cutting rates and secondly, it may reduce by more than 25 basis points.

Since the rate cut has been priced in, traders should look for an intra-day reversal due to profit-taking and position squaring ahead of tomorrow’s U.S. jobs report.