Investing.com’s stocks of the week

This week’s failed rally in the September euro indicates that investors are losing confidence that the European Central Bank will deliver the additional stimulus needed to fulfill a pledge by its President Mario Draghi. Additionally, better-than-expected U.S. economic news is likely to allow the Fed to wait longer before applying additional quantitative easing. This news has encouraged bearish traders to cover their short positions in the U.S. dollar while reviving interest in the long side of the greenback for some speculators.

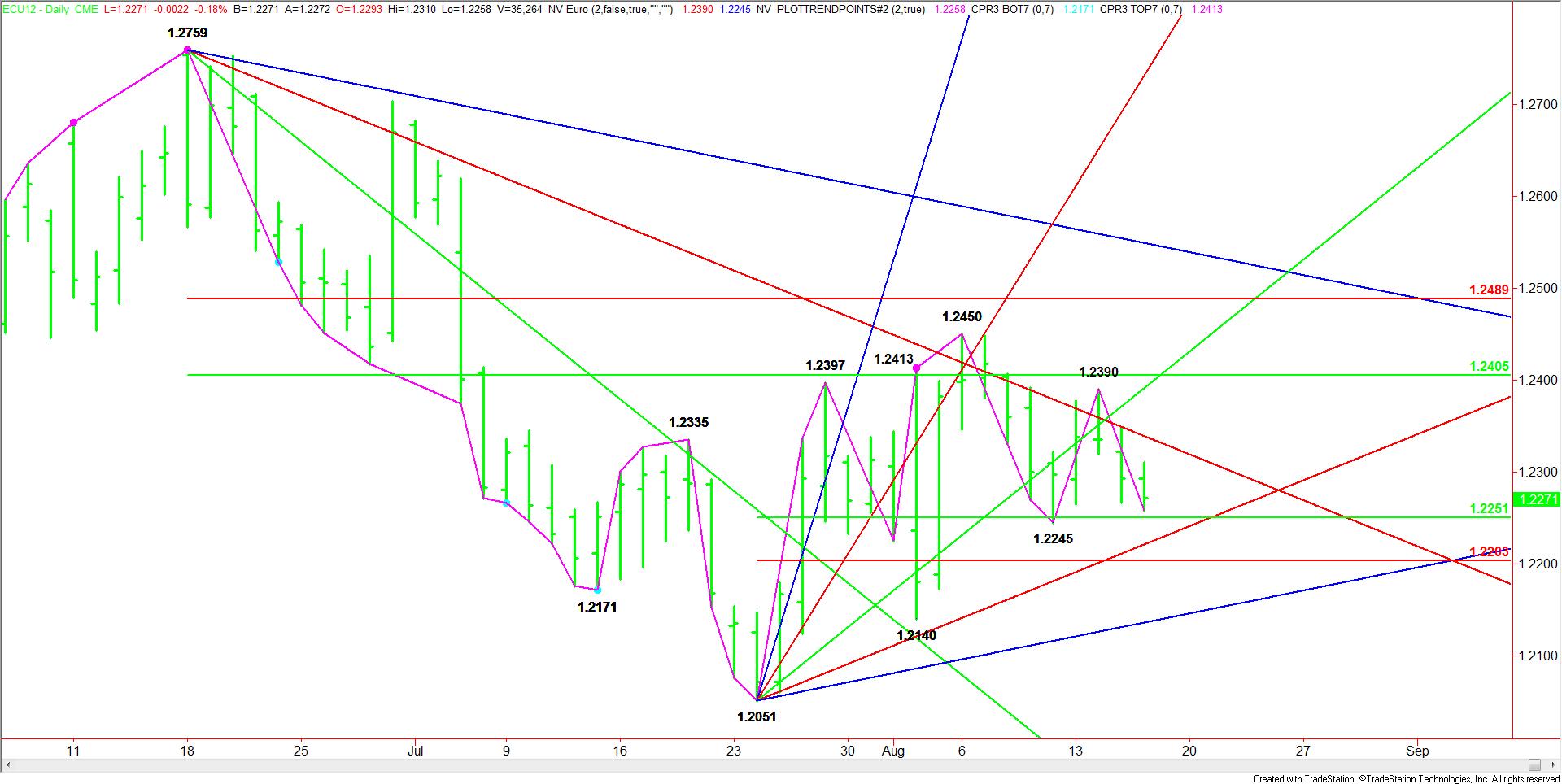

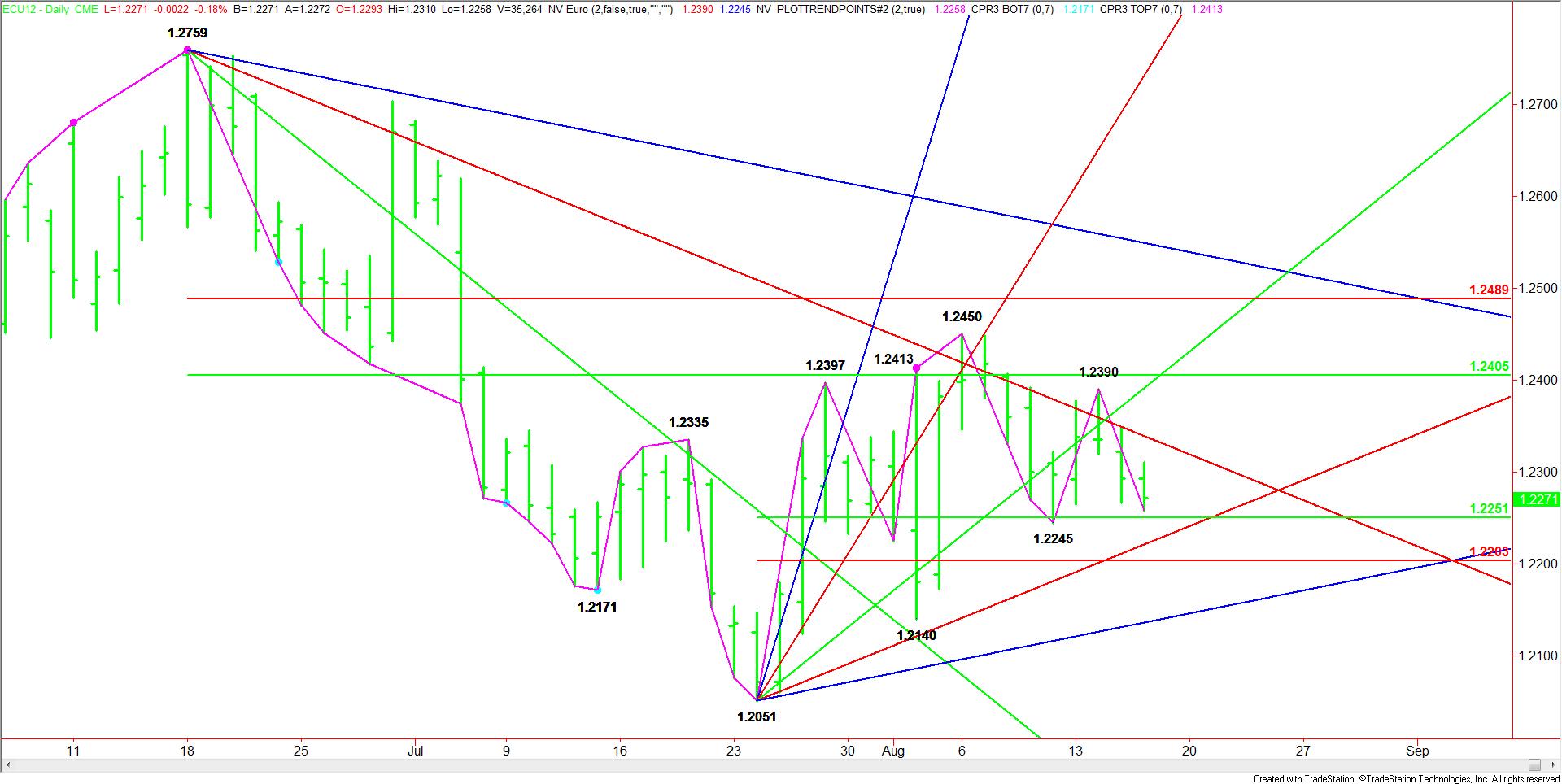

Technically, the daily September euro suggests the market is poised for a retest of 1.2251. This price level is 50% of the main range of 1.2051 to 1.2450. Last week the market tested this level when it bottomed at 1.2245. The successful test led to a quick two-day rally to 1.2390.

Now that a secondary lower-top has been formed at 1.2390, the market is in a position to change the main trend to down on the daily chart on a move through 1.2245. This would set up a test of an uptrending Gann angle at 1.2221. A break through this angle will lead to a test of a Fibonacci price level at 1.2203. On the upside, downtrending resistance at 1.2339 is helping to guide the euro lower. Holding the bottom at 1.2245 and rallying through 1.2390 will reaffirm the uptrend.

With the euro in a position to continue lower over the near-term and the ECB unlikely to begin purchasing Spanish or Italian bonds, the single-currency may accelerate to the downside if interest rates begin to rise above critical levels in these two countries.

Technically, the daily September euro suggests the market is poised for a retest of 1.2251. This price level is 50% of the main range of 1.2051 to 1.2450. Last week the market tested this level when it bottomed at 1.2245. The successful test led to a quick two-day rally to 1.2390.

Now that a secondary lower-top has been formed at 1.2390, the market is in a position to change the main trend to down on the daily chart on a move through 1.2245. This would set up a test of an uptrending Gann angle at 1.2221. A break through this angle will lead to a test of a Fibonacci price level at 1.2203. On the upside, downtrending resistance at 1.2339 is helping to guide the euro lower. Holding the bottom at 1.2245 and rallying through 1.2390 will reaffirm the uptrend.

With the euro in a position to continue lower over the near-term and the ECB unlikely to begin purchasing Spanish or Italian bonds, the single-currency may accelerate to the downside if interest rates begin to rise above critical levels in these two countries.