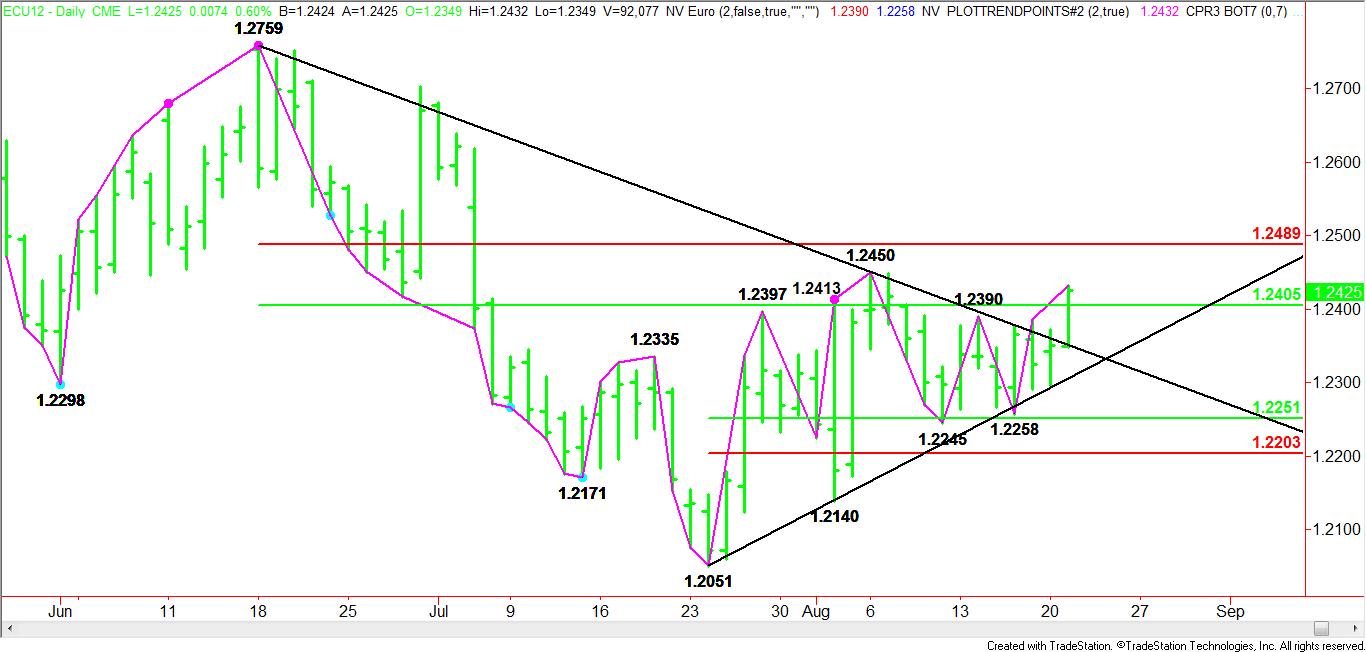

The September Euro is breaking out over the resistance line of triangle chart pattern, perhaps setting the tone for a bullish trading day. In addition to the trend line, the single currency is currently approaching a previous main top at 1.2390 and a major 50% price level at 1.2405. Overtaking all of these levels will put the Euro in a position to challenge the August 6 top at 1.2450.

A trade through this top will mean the market will have one more upside barrier to overcome at 1.2489. Overtaking this important Fibonacci level will put the market on the bullish side of a major retracement zone, indicating that the buying power is currently stronger than the selling power at current price levels.

Since bottoming at 1.2051 on July 24, the September Euro has zigzagged its way to yesterday's breakout. The first rally most likely took out the short-traders with the subsequent break attracting fresh buyers when the market tested a retracement zone at 1.2251 to 1.2203.

Fundamentally, the September Euro bottomed after European Central Bank President Mario Draghi vowed to do “whatever it takes” to support the Euro. Although traders believed this meant the ECB would begin buying Spanish and Italian debt, it never really followed through on Draghi’s pledge. However, it didn’t seem to matter since interest rates have dropped in Spain and Italy anyway, easing some of the pressure on the Euro.

Problems still persist in the Euro Zone, but the current retracement on the daily chart suggests that short traders are not going to stand in the way of this rally until the currency reaches more attractive price levels or until the crisis rears its ugly head once again. Until then, don’t fight the trend on the daily chart.

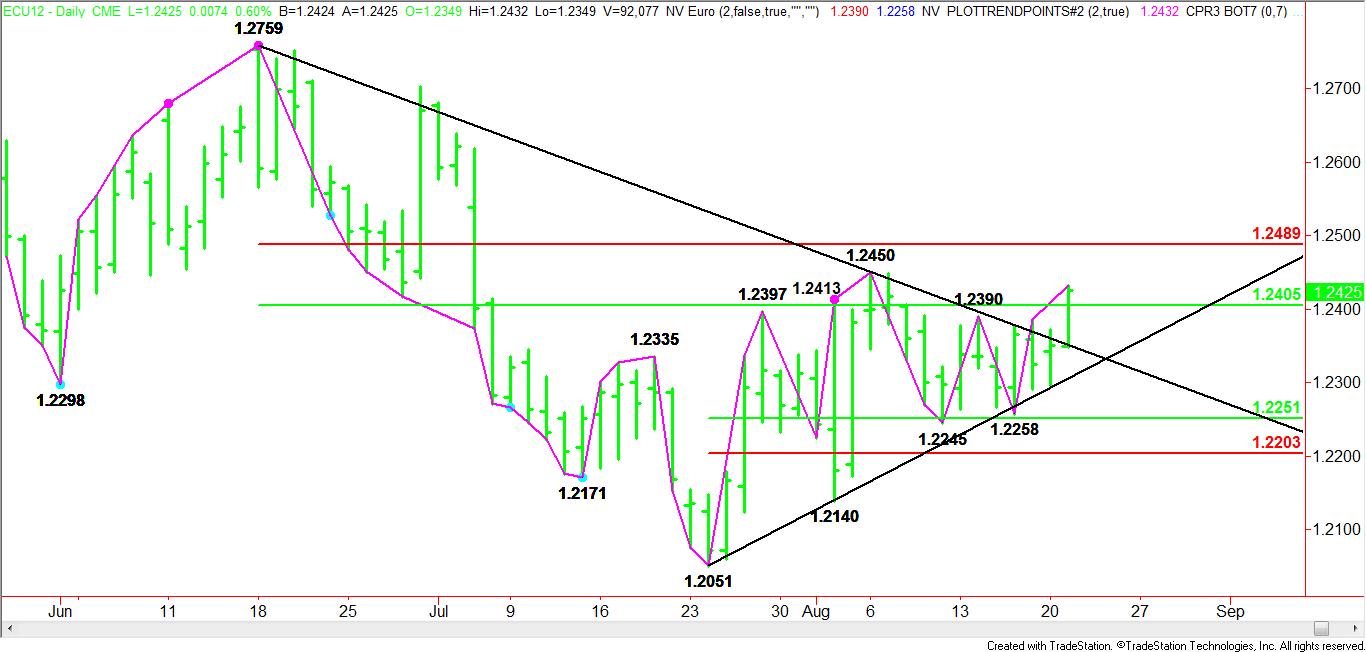

A trade through this top will mean the market will have one more upside barrier to overcome at 1.2489. Overtaking this important Fibonacci level will put the market on the bullish side of a major retracement zone, indicating that the buying power is currently stronger than the selling power at current price levels.

Since bottoming at 1.2051 on July 24, the September Euro has zigzagged its way to yesterday's breakout. The first rally most likely took out the short-traders with the subsequent break attracting fresh buyers when the market tested a retracement zone at 1.2251 to 1.2203.

Fundamentally, the September Euro bottomed after European Central Bank President Mario Draghi vowed to do “whatever it takes” to support the Euro. Although traders believed this meant the ECB would begin buying Spanish and Italian debt, it never really followed through on Draghi’s pledge. However, it didn’t seem to matter since interest rates have dropped in Spain and Italy anyway, easing some of the pressure on the Euro.

Problems still persist in the Euro Zone, but the current retracement on the daily chart suggests that short traders are not going to stand in the way of this rally until the currency reaches more attractive price levels or until the crisis rears its ugly head once again. Until then, don’t fight the trend on the daily chart.