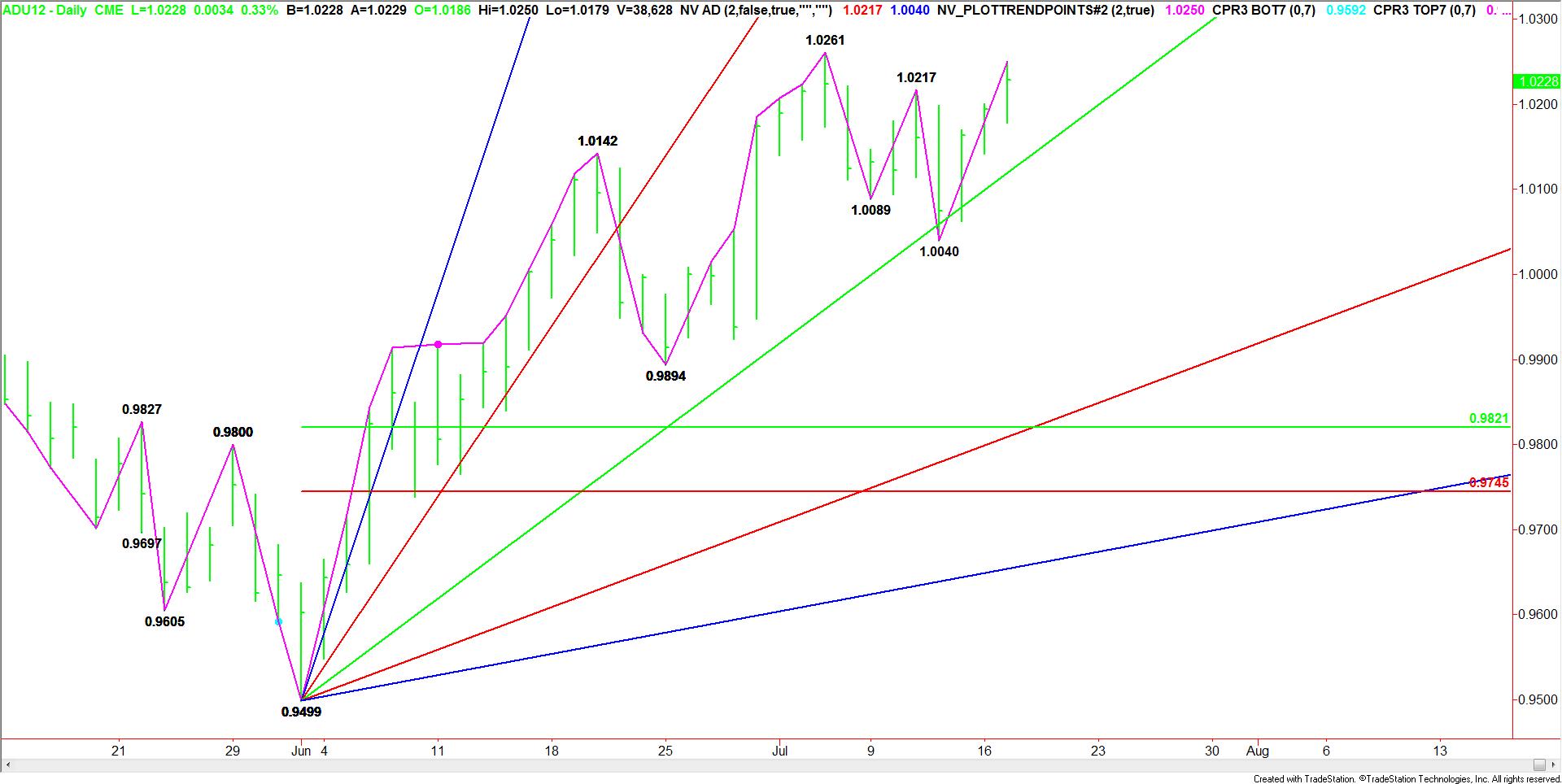

The September Australian Dollar is posting a solid gain this morning after taking out its most recent top at 1.0217. The strong move has put the Aussie in a position to challenge the July 5 top at 1.0261. A move through this level will make the April 27 top the next potential upside target.

Early last week the Australian Dollar penetrated an uptrending Gann angle currently at 1.0139. Since the main trend was down on the daily chart, this move should have attracted additional selling pressure, but shorts began covering after rumors spread of possible additional stimulus from a collection of central banks. These rumors have persisted for several days without any substantiation.

Today and tomorrow, U.S. Federal Reserve Chairman Ben Bernanke speaks before Congress and he could put an end to speculation that the Fed is ready to implement another round of quantitative easing. Since U.S. Retail Sales unexpectedly fell last month as reported yesterday, the U.S. Dollar declined against the Australian Dollar as traders bet that the Fed would act on this news.

Bernanke isn’t expected to come right out and say the Fed is ready to move, but traders will be looking for hints in his speech. He may not even talk about QE at all which will be a disappointment for traders. This could trigger a turnaround in the dollar and put pressure on the Aussie. Some feel that Bernanke will focus on the deficit and make suggestions regarding increasing taxes and avoiding severe austerity measures.

Besides the Fed, traders are also pricing in the possibility that the European Central Bank and China’s central bank stand ready to boost their economies with new stimulus. Volatile moves could be triggered if Bernanke doesn’t mention anything about quantitative easing but investors decide to place more emphasis on Europe and China coming through with their stimulus packages.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

September Australian Dollar Inching Up Ahead of Bernanke Talk

Published 07/17/2012, 08:27 AM

Updated 05/14/2017, 06:45 AM

September Australian Dollar Inching Up Ahead of Bernanke Talk

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.