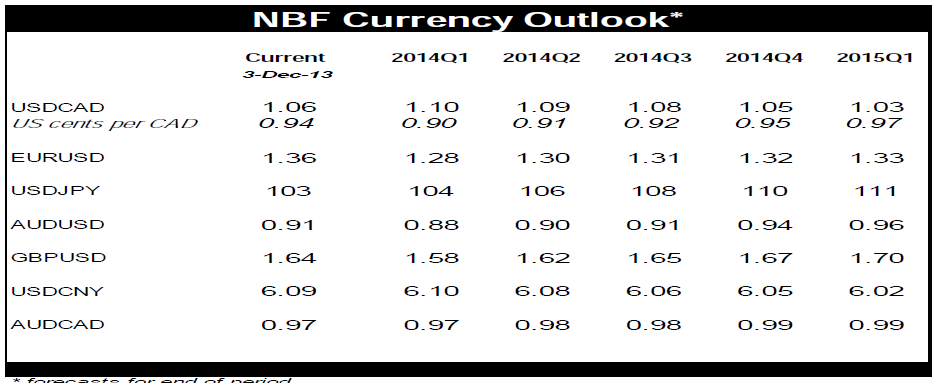

All of a sudden, Canada can’t do anything right. At least that’s what some investors seem to believe given the speed at which sentiment has turned against the loonie. The deal struck by the international community with Iran, which allows for a gradual relaxation of sanctions under some conditions, will eventually add Iranian oil to the global supply pool. That announcement helped trim risk premiums, putting a dent in oil prices and hence the Canadian currency. Further pressure was applied on the C$ by bearish analyst reports. The loonie’s downtrend seems to have momentum, fueled by self-fulfilling negative investor sentiment and partly by a deterioration in the terms of trade. We are adjusting our forecasts accordingly by raising our end-of-Q1 USDCAD target to 1.10, although we expect the currency to stabilize afterwards as economic fundamentals improve.

The euro rallied on news that the zone’s unemployment rate fell one tick to 12.1% and the annual inflation rate rose two ticks to 0.9%. Of course, the bid on the common currency is unwarranted because such awful economic data raises the odds that the European Central Bank will loosen monetary policy not tighten it. We continue to expect the ECB to engage into unconventional monetary policy, e.g. perhaps another LTRO or something a bit more potent early next year, which will incidentally coincide with tapering of the Fed’s asset purchase program, presenting a double whammy for the euro. We are maintaining our 1.28 end-of-2014Q1 target for EURUSD.

Fed tapering and the USD The Fed may not have a better opportunity to start tapering its asset purchases. The US economy just topped expectations by growing roughly 3% annualized in the third quarter, while the labour market continues to improve, having created over 185,000 net new jobs per month on average in the

first ten months this year. True, there are still some uncertainties with regards to fiscal policy, but given the beating taken in the polls by the instigators of the October government shutdown, there may be little appetite for a repeat performance in early 2014. The December FOMC meeting, which will coincide with new US economic projections being released, seems like a good time for the Fed to finally provide details about its plan to reduce its asset purchases perhaps starting in early 2014. The latest FOMC meeting minutes indeed suggested that the Fed maintains its tapering bias, something that encouraged bids on the world’s reserve currency, including from speculators who took their net long USD positions to the highest in over two months.

To Read the Entire Report Please Click on the pdf File Below.

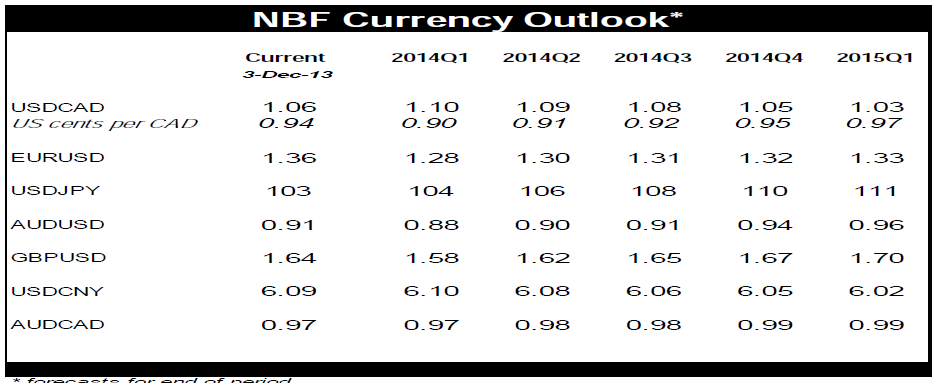

The euro rallied on news that the zone’s unemployment rate fell one tick to 12.1% and the annual inflation rate rose two ticks to 0.9%. Of course, the bid on the common currency is unwarranted because such awful economic data raises the odds that the European Central Bank will loosen monetary policy not tighten it. We continue to expect the ECB to engage into unconventional monetary policy, e.g. perhaps another LTRO or something a bit more potent early next year, which will incidentally coincide with tapering of the Fed’s asset purchase program, presenting a double whammy for the euro. We are maintaining our 1.28 end-of-2014Q1 target for EURUSD.

Fed tapering and the USD The Fed may not have a better opportunity to start tapering its asset purchases. The US economy just topped expectations by growing roughly 3% annualized in the third quarter, while the labour market continues to improve, having created over 185,000 net new jobs per month on average in the

first ten months this year. True, there are still some uncertainties with regards to fiscal policy, but given the beating taken in the polls by the instigators of the October government shutdown, there may be little appetite for a repeat performance in early 2014. The December FOMC meeting, which will coincide with new US economic projections being released, seems like a good time for the Fed to finally provide details about its plan to reduce its asset purchases perhaps starting in early 2014. The latest FOMC meeting minutes indeed suggested that the Fed maintains its tapering bias, something that encouraged bids on the world’s reserve currency, including from speculators who took their net long USD positions to the highest in over two months.

To Read the Entire Report Please Click on the pdf File Below.