- Rate cut expectations take another hit after upbeat PMIs

- Dollar rises to 10-day high, Nvidia (NASDAQ:NVDA) rally unable to lift Wall Street

- Higher for longer weighs on oil and gold

Fed may not cut until after election

It’s been a bad week for investors hoping to see a near-term rate cut by the Fed as expectations have been pushed out further towards the end of the year. The hawkish commentary by Fed officials on Tuesday was underscored by the FOMC minutes on Wednesday. But topping it all up on Thursday were better-than-expected flash PMIs that pointed to a pickup in both business activity and prices in May.

The composite PMI, covering both manufacturing and services, was the strongest in two years. The most worrying aspect of the S&P Global survey was the acceleration in input and output costs, with only employment registering some weakness.

The data strengthened the case for ‘higher for longer’, with the Atlanta Fed’s Bostic signalling on Thursday that a rate cut may have to be delayed until the last three months of the year.

Only last week hopes for a September cut got a major boost from a tame inflation report. But September is now looking more of a toss coin and the first cut is not substantially priced in until November, which is not a live meeting due to the US presidential election. That only leaves December as the most likely meeting for the Fed to feel confident enough to start lowering rates.

Equities stumble despite Nvidia lifeline

For the markets, which have had to contend with repeated disappointments on how soon the Fed can begin cutting rates, this latest setback came as quite a blow for Wall Street. The Dow Jones plunged by just over 1.5% and the Nasdaq reversed sharply from all-time highs earlier in the session to close down by about 0.4%.

Not even a 9.3% rally in Nvidia could prop up the market as the increasingly cloudy outlook for the Fed policy path unnerved investors. Nvidia’s share price surpassed $1,000 for the first time after the AI chip maker posted a triple-digit earnings growth.

Oil and gold headed for weekly losses

The diminishing expectations for rate cuts have also been a significant drag on oil and gold prices this week.

There’s a possibility that OPEC will push for steeper production cuts when it meets at the beginning of June amid the less optimistic demand outlook, but it’s hard to see an agreement beyond an extension of the existing quotas.

Gold’s slide, meanwhile, has likely been exacerbated by profit taking, although a further rebound in US Treasury yields could turn into a bigger headache for the precious metal.

Dollar stands tall but euro and pound find support

The US dollar edged up for the fourth straight session on Thursday before easing slightly today. The euro found support from a surprise rise in negotiated wage growth in nine Eurozone countries. Although the Q1 data – watched closely by the ECB – was impacted by one-off bonuses in Germany, ECB policymakers may now be wary of signalling more cuts after June.

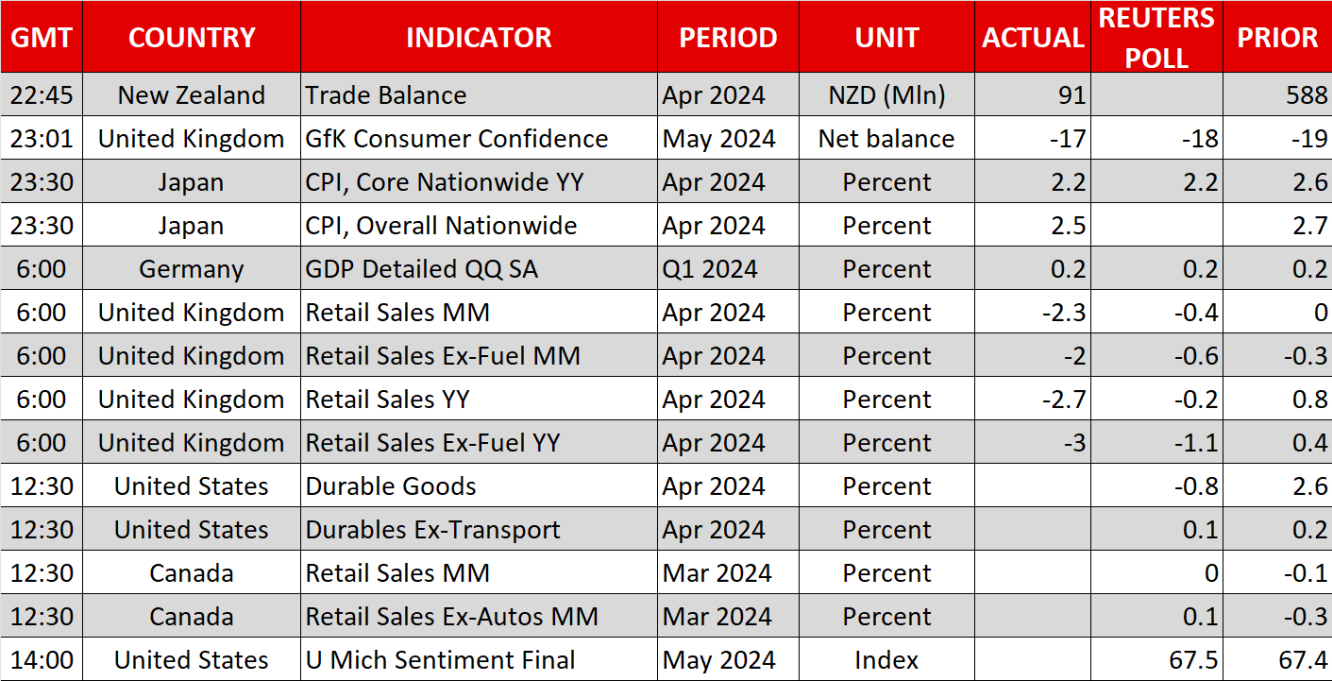

The pound also slipped versus the dollar yesterday but was clawing higher on Friday despite poor UK retail sales readings. A BoE cut in June has been all but ruled out after this week’s upside CPI surprise and the general election announcement. This could defend sterling should the greenback appreciate further in the coming days.