By Tom Kool

Oil markets are looking increasingly bullish as analysts argue that the impact of Omicron on global oil demand will be limited.

Chart Of The Week

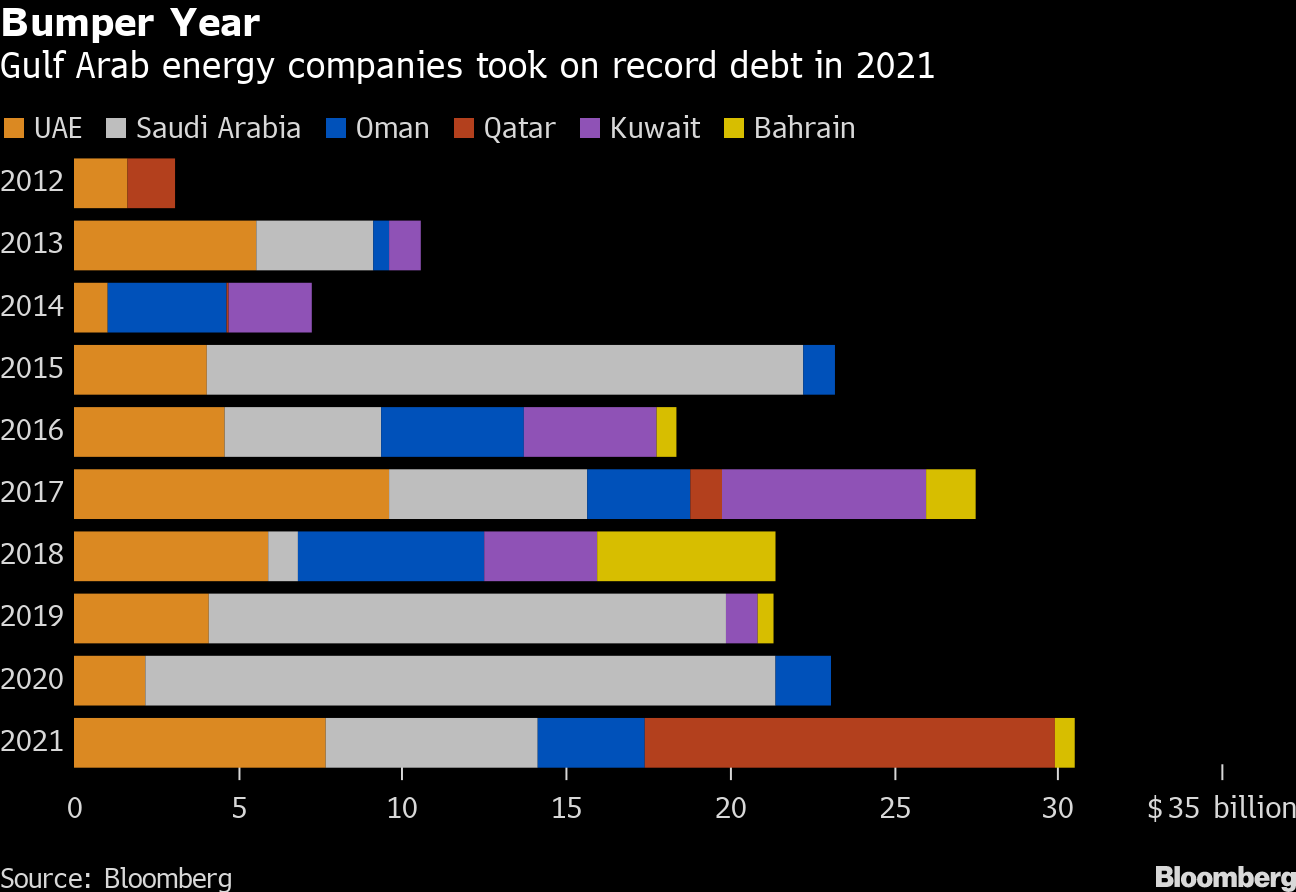

- Energy companies from the Persian Gulf have borrowed 30.5 billion in 2021, according to Bloomberg, the highest level in at least 25 years as regional NOCs seek foreign investment to fund their ambitious plans.

- Qatar Energy was the leader amongst all NOCs, selling $12.5 billion of bonds in July 2021 (the biggest emerging-market offering of last year) as part of financing its LNG capacity expansion.

- Dominating the previous years’ borrowing lists, Saudi Aramco (SE:2222) ranked only third in 2021 behind QE and ADNOC, having ‘only’ raised $6.5 billion, a third of what it did in 2020.

- The global energy transition is softening the traditionally self-reliant stance of Middle Eastern producers as they sell and share more, whilst seeking to maximize gains from their vast hydrocarbon reserves.

Market Movers

- US oil major Exxon Mobil (NYSE:XOM) said it expects Q4 2021 profit to be as much as $1.9 billion higher quarter-on-quarter, buoyed by a $1 billion quarterly windfall from a rally in natural gas prices.

- US LNG developer NextDecade Corp (NASDAQ:NEXT) stated that a final investment decision on its planned $15.7 billion Rio Grande LNG project would be delayed again, for the second time already, as relatively low gas prices hinder the conclusion of long-term supply contracts.

- Norway’s oil major Equinor (NYSE:EQNR) might see its production plans jeopardized after the European Court of Human Rights stepped in to assess whether drilling in the Arctic seas might constitute a breach of fundamental freedoms.

Tuesday, Jan. 4, 2022

There was a noticeable shift in sentiment in the oil market, with an increasing number of forecasts stating that demand destruction coming from the Omicron variant would not be as bad as previous variants due to the absence of widespread lockdowns. Sure enough, cases were climbing in key areas, but governments were reluctant to repeat 2020/2021 policies.

Oil demand remained solid in December, essentially trending on par with November levels, while global manufacturing activity strengthened globally amidst easing supply chain bottlenecks. Thus, the bullish case for more OPEC+ crude is by no means paradoxical, especially when one considers all the supply-side disruptions in Libya and elsewhere.

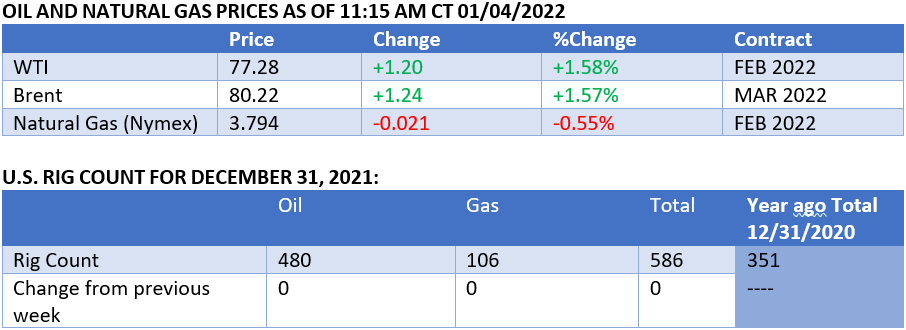

As a result, ICE Brent traded above the $80 per barrel threshold this week, while US benchmark WTI was hovering around $77.5 per barrel.

OPEC+ Agreed to another output increase in February. The group of oil producers comprising OPEC and non-member participants including Russia agreed to extend the 400,000 b/d monthly supply increments into February 2022, arguing that overblown Omicron fears will not have a significant impact on global demand going forward.

New OPEC Secretary-General vowed to keep OPEC+ pact alive. Kuwaiti oil sector veteran Haitham al-Ghais, OPEC’s newly-elected secretary-general that will replace Nigeria’s Mohammad Barkindo starting Aug. 1, 2022, vowed to keep the extended OPEC+ alive beyond its assumed phase-out in late 2022.

Libya fell further into abyss of chaos. Libya’s national oil company announced that the country’s oil production would be reduced by 200,000 b/d as a leaking trunk pipeline will be undergoing maintenance, essentially halving the North African country’s production to 700,000 b/d amid persisting blockades in its western regions.

EU accused of trying to bury New Year’s Taxonomy draft. Environmental groups unleashed an avalanche of criticism on the ‘sustainable finance taxonomy’ of the European Commission stipulating that both gas and nuclear are compatible with green objectives, arguing Brussels tried to bury it by issuing it on New Year’s Eve.

Russian gas flows still in reverse. Gas flows via the Yamal-Europe gas pipeline have been in reverse mode (i.e., moving from Germany to Poland) for the 15th straight day, dumbfounding market watchers as Gazprom (MCX:GAZP) was seemingly reluctant to ramp up pipeline gas exports towards Europe.

McDermott wins Qatar LNG expansion deal. US engineering firm McDermott was awarded a major construction contract (13 wellhead platform topsides and infrastructure around them) for Qatar’s liquefaction facilities that would see its production capacity rise to 126 million tons per year.

ADNOC to finish cavern oil storage soon. The Emirati national oil company ADNOC will soon commission a major expansion of its crude oil storage capacity at the country’s largest port of Fujairah, set in underground caverns whose storage space totals 42 million barrels of oil.

Despite infighting, Algeria wants back into Libya. Algeria’s national oil company Sonatrach announced it would resume temporarily suspended oil projects in Libya, despite the latter descending into a vortex of internal strife on the back of failed presidential elections.

Warm weather helps Europe’s pressured gas market. Temperatures well above the historical average have eased the pressure on Europe’s tight gas inventories and brought day-ahead TTF spot gas prices below €70 per MWh ($24 per mmBtu), only to bounce back today on the news of still-tight Russian supplies.

Indonesia coal export ban shakes market. The government of Indonesia, the world’s leading thermal coal exporter, banned all coal exports out of concerns that the Southeast Asian country could not meet its own power demand, sending coal prices higher amidst falling natural gas quotes.

BP and ENI take center stage in Egypt licensing round. UK energy firm BP (NYSE:BP) and Italian oil major ENI (NYSE:E) have been amongst the most active in Egypt’s most recent upstream licensing round, with a total of 8 blocks allocated against a $250 million investment commitment.

Chinese malaise weakens iron ore prospects. Having quadrupled in 2019 and tripled in 2020, Iron ore prices recorded their first annual decline in three years, dropping 12% year-on-year on weaker-than-previously Chinese demand, with Dalian iron ore futures currently trading around ¥680 per metric tonne ($105/mt).

Germany only one step away from full nuclear phase-out. By pulling the plug on the Brokdorf, Grohnde, and Gundremmingen nuclear reactors on New Year’s Eve, Germany has now only three plants operating and will see a full nuclear phase-out by the end of 2022, just as the EU acknowledged nuclear as a sustainable energy source.