Investing.com’s stocks of the week

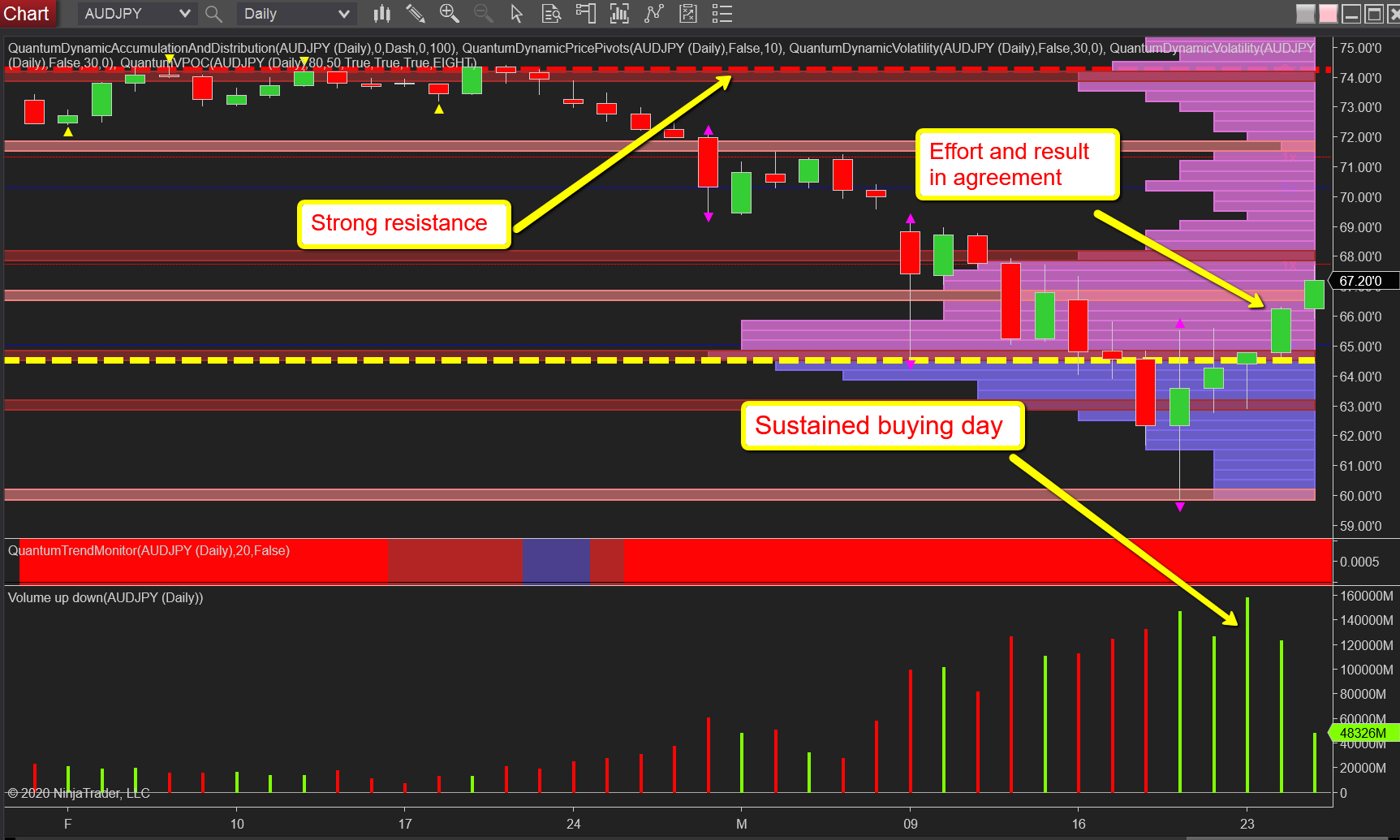

Volume price analysis is a universal methodology that can be applied to all markets, whether spot, cash or futures, a fact often overlooked by many traders, and in particular those trading currencies. This is a huge mistake in my opinion and for evidence of this, we need to look no further than the daily chart for the AUD/JPY. I previously used the below chart to highlight the strength of buying which was now self-evident and a classic example of Wyckoff’s third law of effort and result.

In simple terms, this effort and result must be in agreement, if not, then it is an anomaly. In this case, we have an anomaly since we have an extreme volume bar, yet the price action has closed with the deep lower wick and above the open. If this were selling the candle should have closed wide and down. It did not. Therefore we can conclude this was sustained buying which drove the price higher.

Whilst price action alone gives us this information, it is only half the picture. It is the volume that confirms the strength of the buying and is, therefore, an insight into how strong the subsequent trend is likely to be. Yesterday’s price action was in agreement. In other words, effort (volume) and the result (price), with a widespread up candle on excellent volume and no wicks above or below. And with risk-on sentiment returning the trend is developing further today with 69.00 and beyond the next logical target for the pair where a low volume node awaits.

As we can see, volume on the histogram to the right of the chart falls away dramatically as we move from the current trading levels, and therefore provides little resistance to the move higher. And provided we maintain risk flows, there is no reason to suppose the pair will not continue the rally as yen selling continues, before hitting major resistance in the 74 area and denoted with the red dashed line of the accumulation and distribution indicator. This is a wide line indicating the strength of resistance in this area which also coincides with an increase in volume on the histogram, so a second reason to expect the pair to consolidate here in due course.