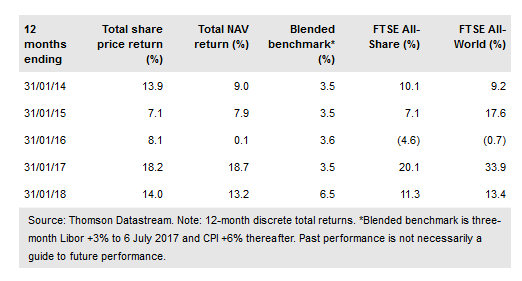

Seneca Global Income Growth (LON:SIGT) has a value-based, multi-asset investment policy, aiming to achieve an average annual return of at least CPI +6% over the course of a normal business cycle, and to grow the annual dividend at least in line with UK inflation. SIGT’s manager believes that active asset allocation can add value and can mitigate the effects of a stock market downturn. In anticipation of an expected global economic downturn in 2020, it has been reducing risk by gradually lowering equity exposure, while adding to specialist assets. The manager expects to continue to reduce the trust's equity position as the end of the bull market approaches. The shorter-term tactical asset allocation (TAA) to equities of 56% compares to the longer-term strategic asset allocation (SAA) of 60%. The trust has a positive investment track record; it has outperformed its blended benchmark over one, three and five years and since the change of investment mandate in January 2012.

Seneca Global Income & Growth Trust (SIGT) has a value-based, multi-asset investment policy, aiming to achieve an average annual return of at least CPI +6% over the course of a normal business cycle, and to grow the annual dividend at least in line with UK inflation. SIGT’s manager believes that active asset allocation can add value and can mitigate the effects of a stock market downturn. In anticipation of an expected global economic downturn in 2020, it has been reducing risk by gradually lowering equity exposure, while adding to specialist assets. The manager expects to continue to reduce the trust's equity position as the end of the bull market approaches. The shorter-term tactical asset allocation (TAA) to equities of 56% compares to the longer-term strategic asset allocation (SAA) of 60%. The trust has a positive investment track record; it has outperformed its blended benchmark over one, three and five years and since the change of investment mandate in January 2012.

To read the entire report Please click on the pdf File Below: