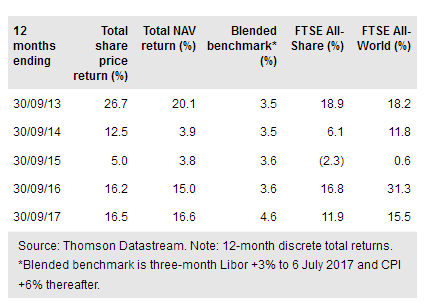

Seneca Global Income & Growth Trust (Seneca Global Income Growth (LON:SIGT)) has changed its benchmark to a more relevant CPI +6% rather than Libor +3%, aiming to achieve an average annual return of 6% above the rate of UK inflation over the course of a typical investment cycle. There has been no change to the investment process; SIGT seeks to generate long-term growth in capital and income, with low volatility of returns, from a portfolio of multiple asset classes. Anticipating a global economic downturn in 2020, SIGT is gradually reducing its equity exposure. At end-September 2017, its tactical asset allocation (TAA) was 59% to equities and 41% to other asset classes, including more than 25% to specialist assets, which generally yield 5-8%. SIGT aims to grow annual dividends at least in line with UK inflation (as achieved in each of the last four financial years). The trust has outperformed its blended benchmark and the FTSE All-Share index over one, three and five years and since its change of mandate in 2012.

Investment strategy: Seeking value from multi-assets

SIGT’s manager, Seneca Investment Managers (SIML) constructs a value-based portfolio of assets across multiple classes: UK and overseas equities, fixed income and specialist assets. The approach is team based; all potential new positions are discussed before being included in the portfolio and SIML employs tactical (shorter-term) asset allocations, within a long-term strategic asset allocation (SAA) framework, aiming to enhance investment returns.

To read the entire report Please click on the pdf File Below: