Multi-asset investment for income and growth

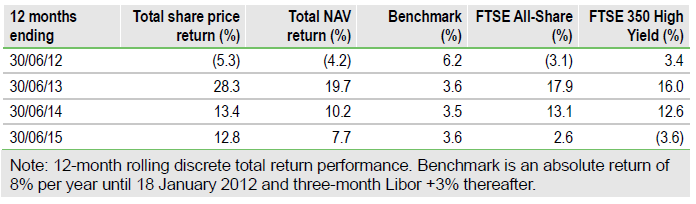

Seneca Global Income & Growth Trust (LONDON:SIGT) is an actively managed closed-ended global income fund differentiated from the majority of peers by its multi-asset approach. SIGT’s NAV total return has outperformed its absolute benchmark as well as the FTSE All-Share index and the peer group average over one and three years and since its investment mandate change in January 2012, with significantly lower than average volatility. Paying quarterly, SIGT aims to pursue a progressive dividend policy and has a prospective 4% yield.

Investment strategy: Top-down, multi-asset approach

SIGT’s investment objective is to outperform three-month Libor plus 3% through investing in a portfolio comprising UK and overseas equities, fixed-interest securities and alternative assets including property. The managers use a structured top-down approach to construct a balanced portfolio with asset allocation varied around a core long-term position with a view to adding value through tactical adjustments within set ranges. In addition to asset allocation, target portfolios comprising the team’s best investment ideas are defined for each asset class and these determine SIGT’s portfolio composition. Exposure to UK equities is gained through direct investment with specialist funds used to provide exposure to overseas equities and the other asset classes.

Market outlook: Favouring equities

While global equity market valuations have been rising and the developed market’s forward P/E multiple is close to a 10-year high, Asian and emerging market valuations are well below peak levels, suggesting that opportunities exist for investors allocating selectively across global markets. While bond markets have recently weakened making yields more attractive, equity market yields in general remain significantly higher, making a favourable relative case for equities. Although global economic growth is maintaining a positive trend, a number of global macroeconomic uncertainties exist and related newsflow could lead to periods of increased market volatility. For investors seeking equity market exposure who wish to moderate market volatility, a multi-asset fund such as SIGT could appeal.

Valuation: Recent discount narrowing

Although subject to some fluctuation, SIGT’s share price discount to cum-income NAV has narrowed substantially from 16% in mid-2012 to the current level of c 1%. The strength in recent NAV performance and 4% prospective yield suggest this narrowing can be maintained.

To Read the Entire Report Please Click on the pdf File Below