Seneca Global Income Growth (LON:SIGT) is an actively managed, multi-asset global income fund. Investments are made in equities (strategic asset allocation of 60%), fixed income (15%) and specialist assets (25%) with the manager taking a long-term perspective.

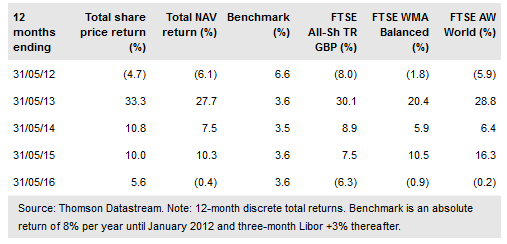

Since the investment mandate change in January 2012, SIGT’s NAV total return has significantly outperformed its benchmark three-month Libor +3% and its NAV has exhibited much lower volatility than the FTSE All-Share index.

Dividends have increased each year since FY13; in the last two financial years the dividend was increased by 4.6% per year. SIGT’s prospective dividend yield is 4.2%. The board has announced its intention to introduce a discount control mechanism, which will commence on 1 August 2016.

Investment strategy: Diversity of income streams

SIGT employs a clearly defined investment process, with a strategic allocation to different assets classes designed to meet the trust’s objectives. This is varied by a tactical asset allocation based on the relative attractiveness of the yield and capital appreciation potential of each asset class.

The trust invests in UK and overseas equities, fixed income and specialist assets, including property and private equity, and its performance is assessed against three-month Libor +3%. UK equity exposure is via direct investment, while the majority of other holdings are investments in dedicated funds. Typically, SIGT holds 60-65 positions.

To read the entire report Please click on the pdf File Below