Semtech Corporation ( (NASDAQ:SMTC) ), a provider of analog and mixed-signal semiconductor products, recently expanded its product portfolio with the launch of two new EcoSpeed DC-DC converters — TS30041Q and TS30042Q.

These devices can be deployed in a wide range of direct current (DC) power applications in the automotive space.

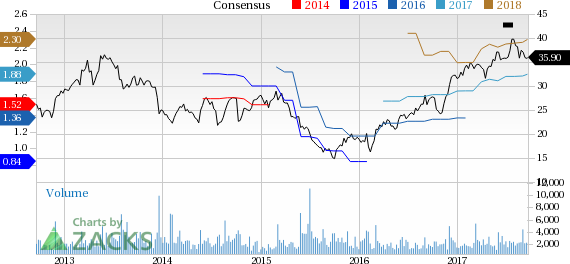

However, the stock has underperformed the industry it belongs to on a year-to-date basis. The company’s shares have gained only 13.5% compared with the industry’s growth of 19.7%.

What are DC-DC Converters?

DC-DC Converter is a type of electronic circuit which converts digital current (DC) voltage level from a lower value to a higher value or vice versa based on the requirements.

These converters can be used in a wide array of applications, namely, power supplies for personal computers, office equipment, spacecraft power systems, heavy trucks, buses, RV vehicles, ships, and lighting systems.

Details

Both these DC-DC converters have been specifically designed keeping in mind the voltage fluctuations requirements and the robust automotive space.

These new devices can operate at up to 90% high efficiency capability and an input voltage range of 4.5V to 40V. The DC-DC switching regulators are fully protected from all kinds of faults that might occur due to voltage fluctuations, including over-current, over-temperature, and VOUT over-voltage. They also feature a switching frequency of 2.2 MHz, enabling the use of smaller filter components, thus resulting in reduced board space and reduced bill of materials (BOM) costs.

Therefore, these devices provide increased flexibility to a wide range of output voltages, thus facilitating better performance, efficiency and reliability.

Priced at $0.63 each in 1,000-piece lots, both the DC-DC converters are available in production quantities.

Bottom Line

The company is witnessing steady improvement in all its products, including DC-DC converters. The global DC-DC converters market is expected to grow at a CAGR of 2.66% between 2016 and 2021, according to a report from marketsandmarkets.com.

Leveraging on its cutting-edge technology, the company manufactures innovative productswhich have always been a fundamental tactic for growth. The latest innovation on the company’s part reinforces this principle.

Key growth drivers for Semtech are product differentiation, operational flexibility and a specific focus on fast-growing segments and regions. The new converters will enhance Semtech’s differentiated product pipeline and is expected to improve its market share in the auto market.

Other Stocks to Consider

Currently, Semtech has a Zacks Rank #4 (Sell). A few better-ranked stocks in the same space are Lam Research Corporation (NASDAQ:LRCX) , Applied Materials (NASDAQ:AMAT) and Stamps.com Inc. (NASDAQ:STMP) , each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lam Research delivered a positive earnings surprise of 4.44%, on average, in the trailing four quarters.

Applied Materials delivered a positive earnings surprise of 2.66%, on average, in the trailing four quarters.

Stamps.com Inc. delivered a positive earnings surprise of 30.64%, on average, in the last four quarters.

4 Promising Stock Picks to Keep an Eye On

With news stories about computer hacking and identity theft becoming increasingly commonplace, the cybersecurity industry looks like a promising investment opportunity. But which stocks should you buy? Zacks just released Cybersecurity: An Investor’s Guide to Locking Down Profits to help answer this question.

This new Special Report gives you the information you need to make well-informed investment choices in this space. More importantly, it also highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Stamps.com Inc. (STMP): Free Stock Analysis Report

Semtech Corporation (SMTC): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research