Semiconductors are an essential part of our daily lives, a geopolitical football of national security interests, and chips are increasingly in demand.

The VanEck Semiconductor ETF (NASDAQ:SMH) potentially indicates new leadership in the beaten-down tech industry.

Institutional investment managers released their 13F filings and sometimes disclosures provide insights.

Warren Buffett's Berkshire Hathaway (NYSE:BRKa) disclosed that it bought a $4 billion stake in chip giant Taiwan Semiconductor Manufacturing (NYSE:TSM).

Why is this significant?

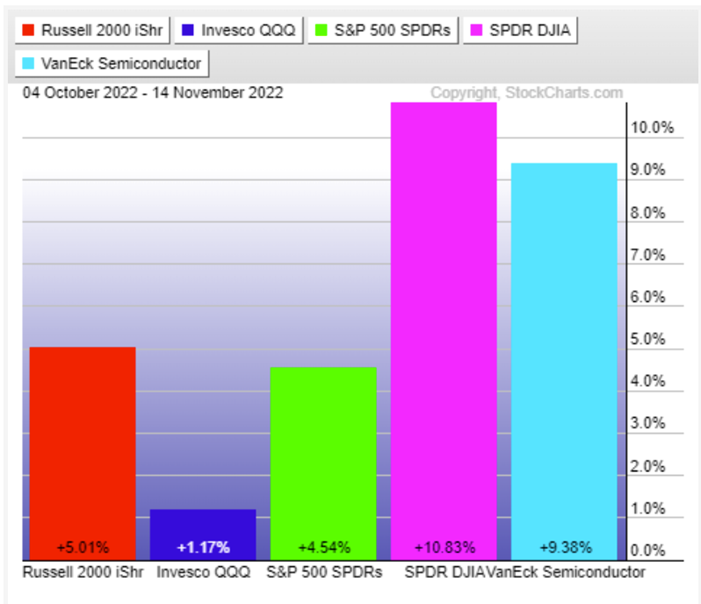

Stock market returns from October 4 to November 14.

Many semiconductor companies outsource the manufacturing of their components to TSMC.

TSMC is also the No. 1 holding in SMH and a Taiwanese firm which brings additional geopolitical risk.

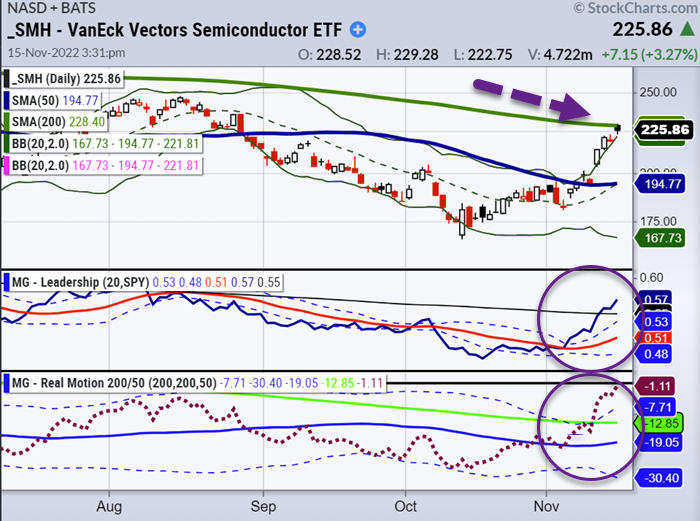

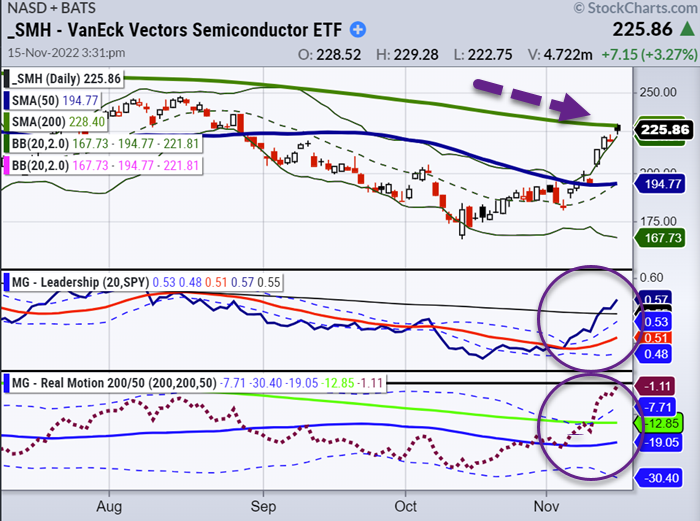

SMH is breaking out of a consolidation pattern. SMH is about to regain the 200-day moving average and closed just below it.

SMH crossed the 50-day moving average at the beginning of the month, and we might see a significant shift in the chip market if SMH can cross the 200-day moving average and hold this higher price level.

The Real Motion Indicator and Triple Play Indicator on SMH show that the momentum, price, and volume trends indicate potential bullishness.

The Triple Play indicator is a strong signal of market leadership, but SMH is also running rich on the Real Motion Indicator.

This could lead to a breakout above the 200-day moving average, but this could also be a risky trade as SMH is subject to potential mean reversion.

So far, the bear market in semis has lasted longer than expected, so traders need to keep an eye on these indicators to position trades correctly.

Keep an eye on SMH to have a better understanding of where technology and the semiconductor business are headed next.

ETF Summary

S&P 500 (SPY) 396 support and 402 resistance

Russell 2000 (IWM) 185 support and 188 resistance

Dow (DIA) 333 support and 339 resistance

Nasdaq (QQQ) 286 support and 293 resistance

KRE (Regional Banks) 62 support and 67 resistance

SMH (Semiconductors) 221 support and 229 resistance

IYT (Transportation) 227 support and 233 resistance

IBB (Biotechnology) 133 support and 137 resistance

XRT (Retail) 64 support and 69 resistance