Since January 2013 we have been using the worldwide Semiconductor Equipment industry as a leader within the semiconductor sector, which is an economic cyclical leader itself. That month we noted a positive move in equipment bookings, which became a (3 month) trend that spring. This trend was used to project positive economic signals to come.

Through some turbulence in 2014 and 2015 the sector has remained on ‘economic up’ along with our cross reference indicator, the palladium/gold ratio right up to the current time as the economic canary in a coal mine has kept on chirping.

But on November 21, two days before the sector topped I derisively poked at the mainstream media for hyping the Semiconductor Equipment sector with its bold headline… Fund manager looks beyond ‘FAANG’ stocks and finds even bigger winners for 2018. Talk about eyeball harvesting and greed stimulation.

The article highlighted a fund manager who’s likely never dirtied his expensive shoes on a factory floor going on about how he has found value in the likes of Applied Materials (NASDAQ:AMAT) and Lam Research (NASDAQ:LRCX). I gave a rebuttal per the link above and noted the reasons why this rosy scenario was unlikely to play out in 2018 for the cycle leading Semi sector and its sub-sector leader, the Fab equipment companies.

So what do we have now? Why, in checks a real source of industry news (unlike the completely abstracted financial media we as investors are routinely subjected to) with affirmation of our November 21 viewpoint.

To review, in 2013 we projected Semi Equipment → Semi → broader Manufacturing → Employment and it has played out that way over time and through much media drama and noise. But now the pace of a cyclical leader is slowing… even as the world stokes up on reflation (AKA fiscally stimulated inflation) and it all appears as good as it gets.

That is key. In Q4 2012 market players were embroiled in the Fiscal Cliff drama as my brother in law (a financial adviser) told me at Thanksgiving how the best and brightest fund managers were hording cash in expectation of a negative market event coming that December due to said Fiscal Cliff. My grunted response (which to this day I wish I’d had ‘all in’ conviction about) was “bullish”. That was the sentiment end of it, and the next month saw the Semi signals start coming in. The rest is history.

But January 2018 is much different than January 2013. Meanwhile, here are a few items from the article.

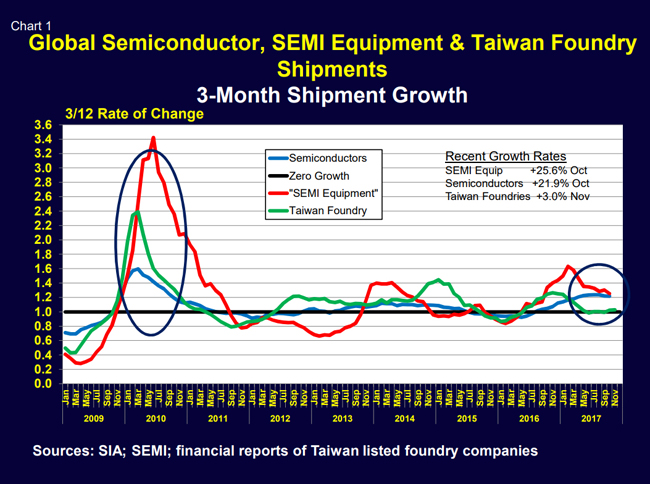

World semiconductor equipment shipment growth was a very robust +26 percent (3-month basis) in October but down from its +63 percent peak in February. By comparison, October global semiconductor shipments were up 22 percent, while November Taiwan chip foundry sales (a leading indicator) were up only 3 percent. Based on Chart 1 it appears the SEMI equipment growth will ease considerably in early 2018.

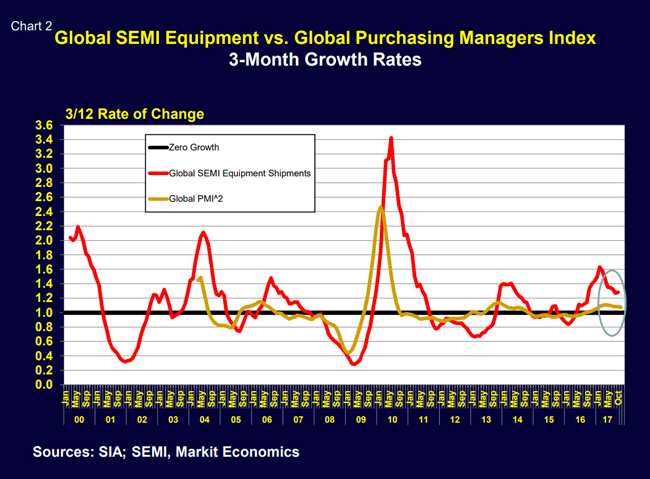

Comparing global SEMI equipment shipments to the Global Purchasing Managers Index (another leading indicator) also suggests that SEMI Equipment shipment growth will ease but still remain positive into the New Year (Chart 2). SEMI equipment demand remains strong, but the “bubble” growth like we experienced in 2017 is typically followed by a downward “correction,” especially since the current buildup in memory chip capacity will likely ebb in 2018.

I recommend you read the rest of the article. It is very short and to the point. The point being that the up cycle on the economic Canary in a Coal Mine is losing momentum and a respected industry source is projecting it to cycle down sharply in 2018. Now, why again did I make fun of the suit who manages other people’s money for a living when he got newly bullish on AMAT and LRCX in November?

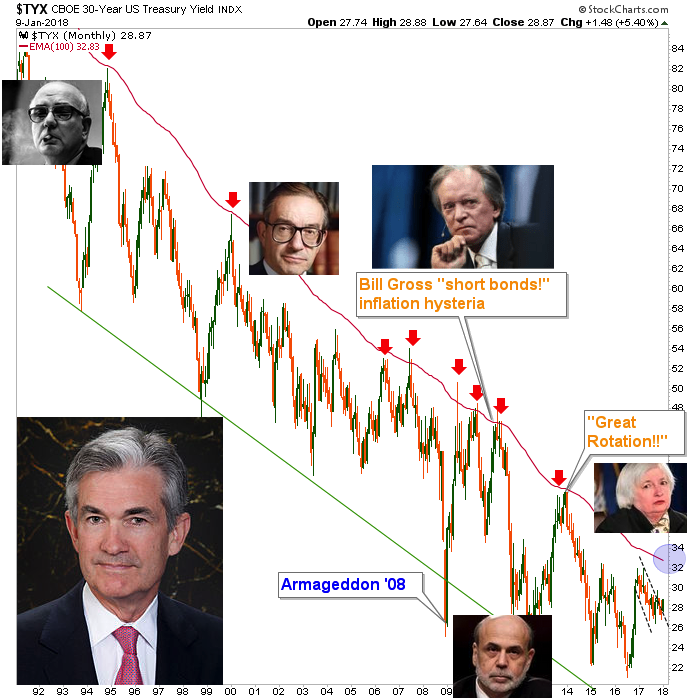

This signal plays into only everything we are currently working on. An ‘inflation trade’ up to the projected limits, amid contrary indicators galore, to get everyone off sides as often happens when the Continuum ™ reaches its limiter. Right now it’s fiscally stimulated inflation and asset prices continuing to rise. But the Canary is going to stop chirping at some point, and then… cue the crickets.

Or for another metaphor, the game of Musical Chairs is going to require you find a seat. While enjoying the current party we are also working on defining the right seats for the hangover phase. Hint: two of them are shiny and made of gold and silver. Hint 2: another digs shiny stuff out of the ground and is counter cyclical.