Investing.com’s stocks of the week

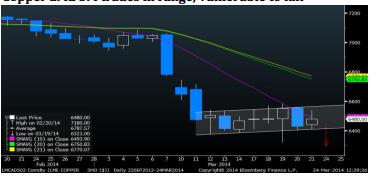

Copper has been one of the worst performers amongst the base metals basket for almost all of March and is currently lower by around 8% at the LME, SHFE and the COMEX. This shows the structural issues pertaining to the metal and so, prices are falling ceaselessly in the near term. Looking at the global price performance, domestic copper prices at the MCX platform have also declined in a similar fashion. As we understand it, the inverse relationship between copper’s price and inventory had been out of synch for a long time, which led to a better relation in March.

Prices have fallen over 8% while the inventories have increased by 6.77% from 0.251 million tons to 0.268 million tons. China has been a major negative factor for the metal lately and in today’s session also we are seeing fresh negative cues from the Chinese economy. Today morning the preliminary PMI manufacturing reading from HSBC and Markit said the reading fell down to 48.1, from last number at 48.5 and lower than markets estimates. This was the third straight monthly fall for the reading wherein we believe it further dents the near term growth prospects about the economy. With China being the major consumer of almost all industrial metals including copper, we feel the above update is expected to further weigh the broad movement in the commodity. We have a selling view for the day.