Urban Outfitters, Inc. (NASDAQ:URBN) is ready to step into the earnings confessional, set for its fourth-quarter report after the market closes this Tuesday, March 5. Ahead of the event, URBN is trading near a trendline that has historically bearish implications.

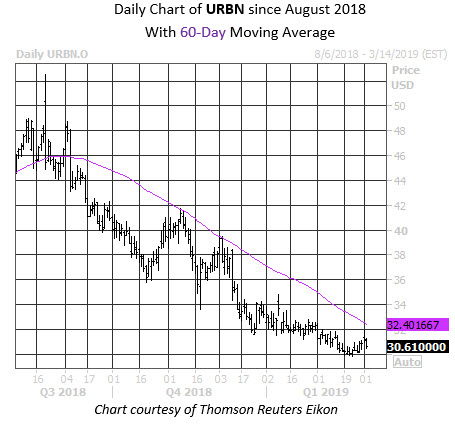

More specifically, Urban Outfitters stock closed Friday within striking distance of its 60-day moving average. The previous times URBN ran up to this moving average after a lengthy stretch below it, the stock averaged a three-week loss of 10.3%, with 100% of the returns negative, according to Schaeffer's Senior Quantitative Analyst Rocky White. At last check, the retail stock is down 2.3% to trade at $30.61, so a drop of similar magnitude would put it at new annual lows around $27.46 a few weeks from now.

URBN has also encountered problems at its 40-day moving average, a bearish trendline that helped nudge the security lower last month. Since its August highs near $52.50, the equity has carved out a channel of lower lows, culminating in Feb. 21 closing low of $30.02.

Looking at Urban Outfitters' earnings history, the equity has closed lower post-earnings in the session following four of its last eight reports. Overall, the shares have averaged a 4.6% price swing the day after reporting, regardless of direction. This time around, URBN options are pricing in a much steeper 12.1% swing for Wednesday's trading.

Options traders have grown increasingly optimistic on the retailer ahead of earnings. The stock's extremely elevated 10-day call/put volume ratio of 8.16 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks in the 98th annual percentile. In other words, URBN calls have been purchased over puts at a faster-than-usual clip in the past two weeks.

Echoing this, the security's Schaeffer's put/call open interest ratio (SOIR) of 0.35 lands in the 7th percentile of its annual range, suggesting near-term options traders are more call-biased than usual right now. Should the stock suffer another rejection from familiar trendline resistance, an exodus among option bulls could apply further pressure to the shares.