This recommendation was emailed to brokerage clients on April 17th 2015:

On the radar:

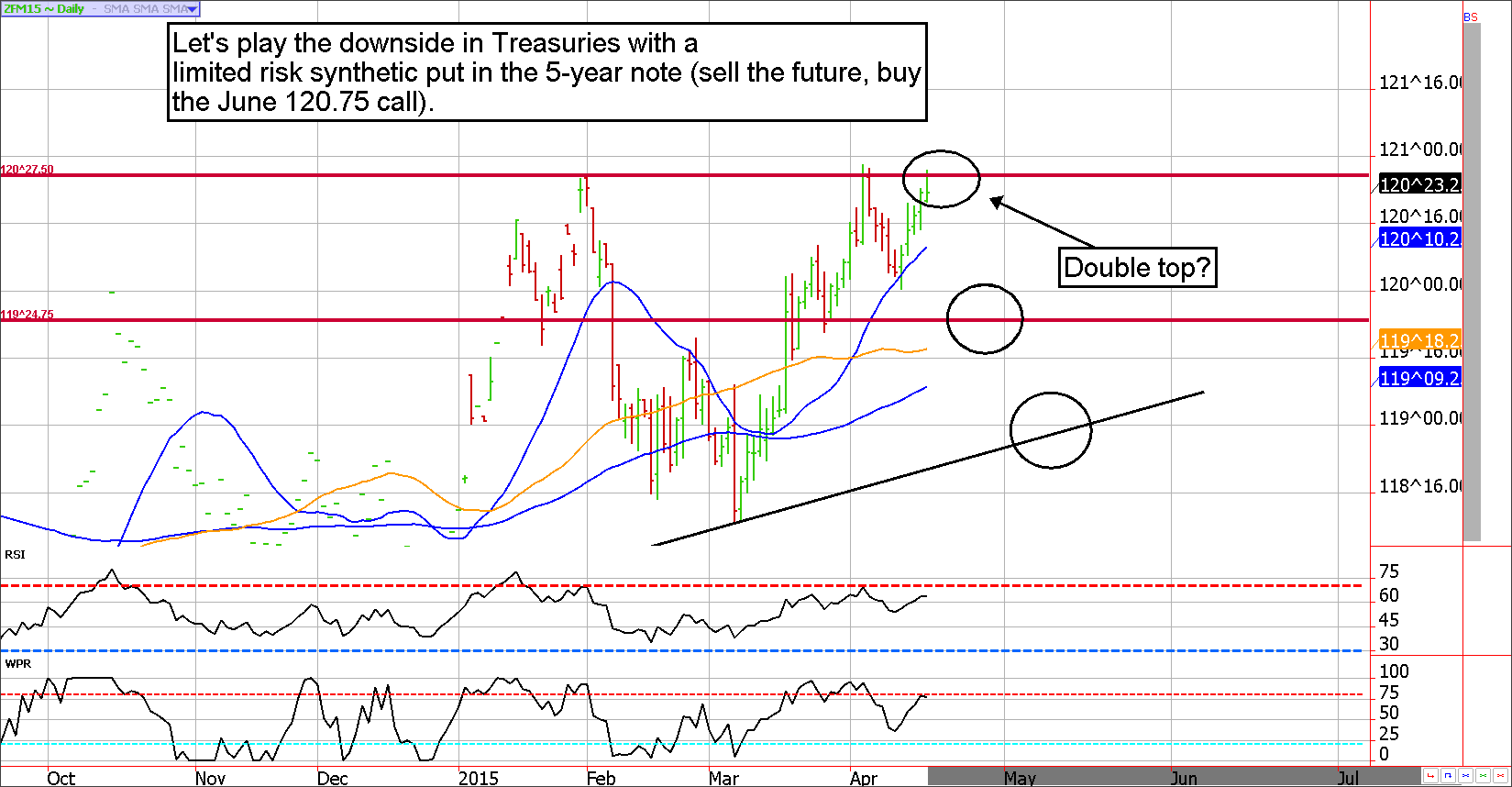

A minor flare up in Greece concern seems to have created a high probability bearish opportunity Treasuries. We like the idea of using a cheap, and limited risk, play in the 5-Year note in hopes of a trend reversal. Let's sell the 5-year note future and buy a call option for insurance

Those looking for a directional play in Treasuries without the massive risk that comes with trading the U.S. 30-Year bond, should look to the 5-year note. The moves are typically less erratic and the options are cheaper, making it possible to employ low risk strategies.

With the Fed's interest rate hike campaign looming in the near future, prices at questionably lofty levels, and our expectations of another new high in equities, it is hard to imagine the 5-year note traveling much beyond the January highs. Thus, we like the idea of going short a June futures contract and purchasing a June 120.75 call.

The cost of the call should be about $360 (23 ticks), which will represent your maximum risk on the trade prior to transaction costs. In other words, this trade will give you 36 days in the market with a risk of under $400, and theoretically unlimited profit potential.

Should things unfold as we think they might, it is possible to see the 5-year note return to the bottom of the trading channel near 119. In such a scenario, this position could potentially be profitable by roughly $1,000. Initial support would come in near 119'24.

Disclosure and Disclaimer: Past performance is not indicative of future results (seasonal data tells us what has happened in the past, not necessarily what will happen in the future). Due to time constraints and our fiduciary duty to put clients first, the charts provided in this newsletter may not reflect the current session data.

Seasonality is already factored into current prices, any references to such does not indicate future market action. There is substantial risk of loss in trading futures and options. Past performance is not indicative of future results.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bearish Treasury Market Opportunity Using Options

Published 04/17/2015, 01:41 PM

Updated 07/09/2023, 06:31 AM

Bearish Treasury Market Opportunity Using Options

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.