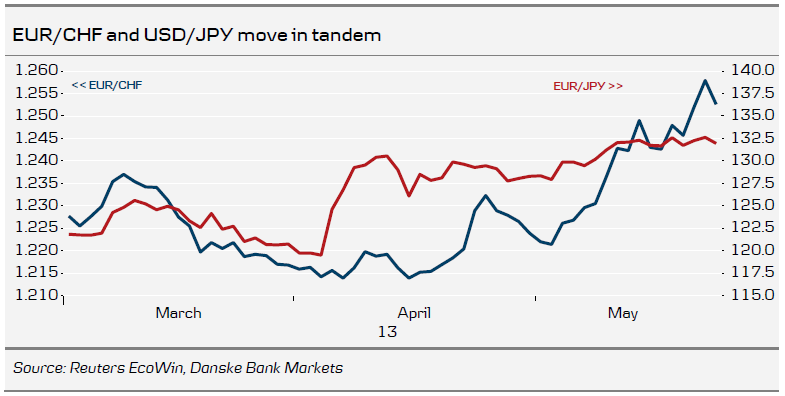

EUR/CHF and EUR/JPY move in tandem

The correlation between JPY and CHF has risen recently, as the EUR/JPY and EUR/CHF continue moving in tandem. The recent move lower in EUR/JPY has been mirrored by a fall in the EUR/CHF and the CHF/JPY has been remarkably stable since the start of April. While this correlation will probably not last forever, it could very well continue for another couple of weeks - or even months.

Front-end volatility looks attractive

We recommend utilizing the recent move higher in implied volatility to sell CHF/JPY straddle, as we expect the cross to continue trading within a relatively narrow range in the near term. Specifically, we recommend selling a two-week 105.50 CHF/JPY straddle. The strategy pays an initial up-front premium of JPY 175 pips (indicative, spot ref.: 105.30) and is profitable, as long as CHF/JPY trades within the range of 103.75 to 107.25 at maturity. The risk to this strategy is a breakdown of the correlation between CHF and JPY and/or yet another change in level like the one we saw at the beginning of April.

To Read the Entire Report Please Click on the pdf File Below.