People are feeling better about spending money. Similarly, investors are feeling better about risking it. The problem is, whenever people begin to feel wealthy due to a faulty premise (i.e., the U.S. Federal Reserve can keep buying bonds to depress interest rates without longer-term implications), they may spend more than they have. Others may blindly chase investment gains without recognizing the actual risks.

For example, all of the hoopla surrounding the 3-month monster rally for U.S. stocks (9%-10%) ignores a disconnect with markets around the world. Recent asset class performance data from Bespoke Research show the largest emerging market economies (e.g., Brazil, Russia, India, China, etc.) collectively logging a loss of -4%; meanwhile, Vanguard MSCI Europe (VGK) only managed a meager 1% in the first quarter.

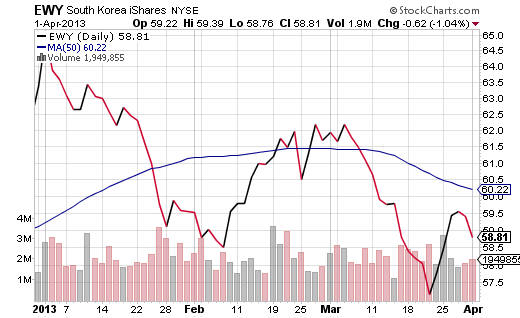

And there’s more. The massive quantitative easing by Japan is causing the currencies of other export-dependent economies to appreciate against the yen. This may have an adverse impact on those export-dependent nations. For example, currency concerns are a contributing factor in the declining fortunes of iShares MSCI South Korea (EWY).

Keep in mind, the price gains that many have enjoyed in broad-based U.S. equities may be transitory. For one thing, the rest of the world’s equity markets have yet to go along for the ride. Secondly, bonds are once again picking up some traction. In addition, U.S. stocks experienced corrective activity in the 2nd quarter of 2010, 2011 as well as 2012, while the S&P 500 has pulled back at least 5% in the first 5 months of every calendar year since 1996.

Naturally, a sell-off may be an occasion to put sidelined cash back to work. The question is… which assets might be worthy of purchasing when it happens? Perhaps it will be those ETFs that do not stumble as severely when European bank solvency dominates the headlines.

Consider the pattern in 2012. Last year, iShares MSCI European Financials (EUFN) fell a bearish 27% from a mid-March peak through a low in June. The SPDR S&P 500 Trust (SPY) fell a more modest 8.5% in a gloomy May-June correction. In contrast, iShares FTSE NAREIT Mortgage REIT (REM) actually gained 8%+ in the 2nd quarter of 2012, while Vanguard Utilities (VPU) and PowerShares Pharmaceuticals (PJP) both picked up roughly 5.8%.

If the pattern holds — with U.S. economic growth potentially slowing in Q2 and European bank risks rising in Q2 — the beneficiaries tend to be domestic non-cyclical segments. Granted, non-cyclical sectors may be somewhat expensive relative to earnings. However, when a sell-off in U.S. and global stock indexes does arrive, investors may continue to place a premium on safe growth/income.

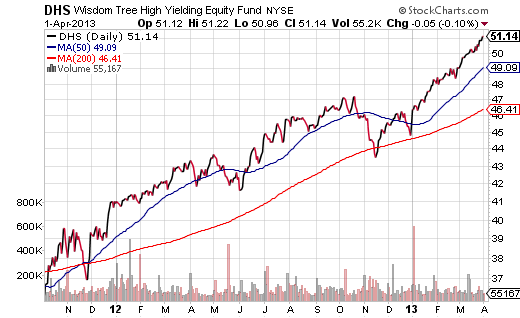

Another way to pursue safer growth and income when the next pullback occurs? WisdomTree High Yielding Equity (DHS). This exchange-traded tracker barely budged when European financials dominated the “sell-in-May” stories in 2012. The SEC 30-day Yield of 3.6% is flanked by its top 4 sectors: Health Care, Consumer Staples, Utilities and Telecom.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Selecting Safer Growth And Income ETFs For The 2nd Quarter Pullback

Published 04/02/2013, 03:26 AM

Selecting Safer Growth And Income ETFs For The 2nd Quarter Pullback

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.