Select Medical Holdings Corp. (NYSE:SEM) reported second-quarter 2017 earnings of 32 cents per share, which surpassed the Zacks Consensus Estimate by 28%. Also, earnings improved year over year by 39.1%. Notably, shares of the company have rallied 12.7% in the last two trading sessions reflecting the bullish results.

Second-quarter results benefited from solid performance across all the segments. Both revenues and margins exhibited improvement.

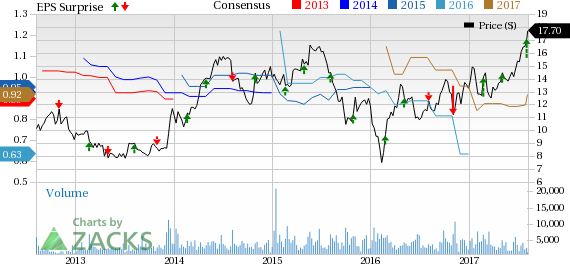

Select Medical Holdings Corporation Price, Consensus and EPS Surprise

Operational Update

Operating revenues of Select Medical grossed $1.12 billion during the quarter, up 2.1% year over year. Higher Outpatient Rehabilitation revenues, Specialty and Concentra revenues led to the upside. The top line missed the Zacks Consensus Estimate by 1.3%.

Total operating expenses amounted to $1 billion, up 0.8% year over year. Increase of 0.4% in cost of services, 5.9% higher depreciation and amortization expenses, 9.3% in general and administrative expenses and 3.8% in bad debt expenses led to the overall rise in expenses.

Income from operations improved 14.5% year over year to $0.1 billion on the back of higher revenues.

Adjusted EBITDA rose 12.2% year over year to $158.7 million.

Segment Update

Specialty Hospitals’ operating revenues rose 2.6% year over year to $601 million.

Adjusted EBITDA was $98.1 million, up 18.7% year over year, with margins expanding 220 basis points (bps) to 16.3%.

Operating revenues from Outpatient Rehabilitation were up 0.5% year over year to $258.1 million, mainly due to higher revenue per visit (increased 1%), which was offset by a lower number of visits (decreased 0.7%).

Adjusted EBITDA rose 9.9% year over year to $41.9 million, while margin expanded 140 bps year over year to 16.2%.

Concentra segment reported net operating revenues of $261.5 million, up 2.6% from the prior-year quarter. Adjusted EBITDA increased 0.05% year over year to $43 million.

Adjusted EBITDA margin declined 40 bps to 16.5%.

Financial Update

Select Medical exited the quarter with cash of $73.7 million, up from $99 million at year-end 2016.

As of Jun 30, 2017, long-term debt, net of current portion, increased to $2.7 billion from $2.6 billion at the end of 2016.

Cash flow from operations was $96.2 million, up from $67.1 million in the year ago quarter.

2017 Guidance

Select Medical estimates earnings per share to be between 78 and 96 cents on revenues of $4.4 billion to $4.6 billion. Net income per share is estimated between 69 and 87 cents.

Adjusted EBITDA is projected between $540 and $580 million.

Zacks Rank

Select Medical presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Performance of Other Health Maintenance Organization Stocks

Among other stocks from the health maintenance organization industry that have reported their second-quarter earnings, the bottom lines of Humana Inc. (NYSE:HUM) , Aetna Inc. (NYSE:AET) and UnitedHealth Group Incorporated (NYSE:UNH) have topped their respective Zacks Consensus Estimate.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Aetna Inc. (AET): Free Stock Analysis Report

Humana Inc. (HUM): Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

Select Medical Holdings Corporation (SEM): Free Stock Analysis Report

Original post

Zacks Investment Research