- Important inflation data hits Tuesday before the Fed finishes its final meeting of the year on Wednesday

- Corporate bond spreads should continue to be monitored, but we are not seeing significant warning signs yet

- High-quality corporate bonds could offer strong diversification benefits

This week we’ll get a pivotal reading on inflation with the November CPI report Tuesday morning. Then comes Wednesday’s Federal Reserve interest rate decision to put the wraps on the FOMC’s two-day meeting—its final gathering of 2022.

Heading into this last volatility catalyst of the year, price action in corporate bonds has been quite interesting.

A Credit Market Review

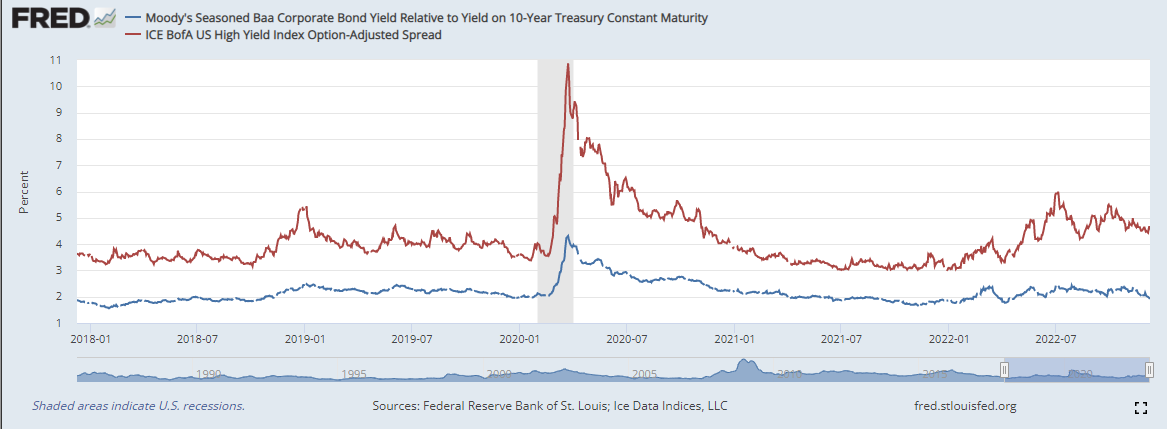

Investment grade and junk debt often see their yields rise relative to Treasuries as fears of corporate bankruptcies often come to fruition when global economic growth heads south. So, what are credit spreads doing right now? Not a whole lot.

That’s an encouraging sign for the bulls as high-grade corporates sell for within 200 basis points of comparable-term Treasury notes while the speculative-grade credit spread is nearly 1.5 percentage points below its early July peak of about 600 basis points.

Source: St. Louis Federal Reserve

As it stands, investment grade bond yields are generally steady, currently at 5.19%, according to the St. Louis Federal Reserve, while junk bonds offer a yield to maturity of 8.36%. Both of those figures are significantly below their 2022 peaks.

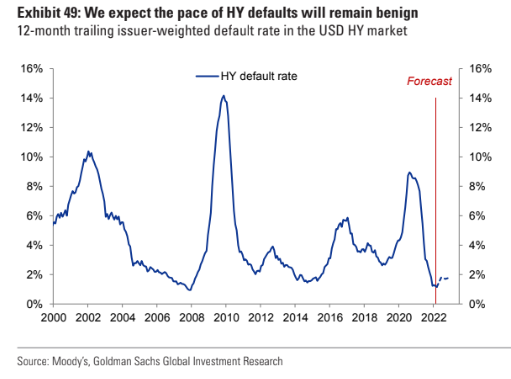

Moreover, the bears often point to an impending blowout of high-yield spreads, perhaps on the order of what we saw during the Great Financial Crisis or, at the worst of the COVID Crash. Goldman Sachs thinks otherwise, as evidenced in the chart below, which forecasts just a modest uptick in the pace of high-yield defaults.

High Yield Defaults Expected to Be Modest

Source: Goldman Sachs Investment Research

A much-improved yield situation leaves investors curious - is earning between 5% and 8% on a diversified portfolio of corporate bonds a good play into what could be a rocky first half of 2022? Consider that U.S. large-cap stocks now trade for about 17 times next year’s forecast earnings, a much higher-than-usual valuation heading into an economic slowdown.

While you and I can earn north of 4% on a money market mutual fund following Wednesday’s imminent Fed rate change, there could be protection offered in higher-duration, high-quality debt, assuming defaults stay muted. Of course, the speculative side of corporate bonds almost always features a positive correlation to equities.

Big Bond Bounce

So, after a bruising stretch from late last year through this past October, the iShares iBoxx Investment Grade Corporate Bond ETF (NYSE:LQD) is up a whopping 11.3% total return over just a handful of weeks. What makes LQD an intriguing product right now is that it features a much higher duration than common high-yield bond plays.

Moreover, with default rates expected to be modest due to the strength of balance sheets among quality firms, LQD should offer a decent yield and event protection due to its interest rate risk/reward profile if a modest recession strikes, forcing the Fed to cut rates later on.

The Bottom Line

Is it different this time? Will high-quality corporates provide protection during a recession?

Hard to say, but with a yield to maturity above 5%, somewhat elevated duration, and low chances of a significant uptick in defaults, LQD might once again provide ballast to a stock-heavy portfolio.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.