Strategic commitment to the transport market

A net £15m (c A$27.5m) fund-raising announced in late November was approved by Seeing Machines, (SEE.L) shareholders at an EGM last week. While there is a dilution impact from the fund-raising, the money raised will accelerate DSS (Driver State Sensor) revenues by providing extra working capital to speed up the manufacturing cycle. It will also enable the group to significantly accelerate its moves into new markets. We expect the group to maintain its focus on the broad automotive/transport sector and control rooms. Therefore, while c 40x our updated FY15 earnings looks expensive, the business now has a far stronger foundation for growth.

Fund-raising: £16m gross (c A$29.4m), c £15m net

SM is raising £16m gross (c £15m net) via a share placement of 320m new ordinary shares at 5p. It is now setting out its plans to invest the money and we expect to hear news on the group’s new business plan around the time of the interim results in late March.

First CAT dealer signed up as a distributor

In December, SM announced it had signed up its first Cat dealer as a DSS distributor to the mining industry, as part of SM’s agreement with Caterpillar. We also understand that Cat-driven sales activities are gaining significant momentum.

European coach trials

Also in December, SM announced a trial of the DSS with Royal Beuk, a Dutch luxury coach company. The plan is for Royal Beuk to become SM’s distributor of the DSS to the coach and road transport sector in this region. However, this is strictly a trial, as SM has yet to agree a business model with Royal Beuk.

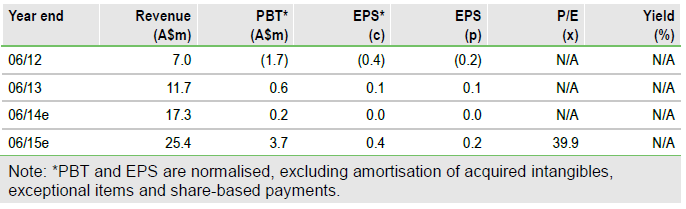

Forecasts: Costs move up, revenues rise from FY15

We have made initial adjustments to our forecasts for the capital raising. We have added A$1m of operating costs in FY14 while maintaining revenues. For FY15, we have increased revenues by A$2.5m, while operating profits are little changed.

Valuation: Underpinned by road transport opportunity

On our new forecasts, the stock looks punchy trading on c 40x FY15 EPS. However, we have not as yet included any assumptions on SM’s moves into new areas, such as coaches, and our haul truck sector forecasts remain conservative.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Seeing Machines: Underpinned By Road Transport Opportunity

Published 01/07/2014, 07:27 AM

Updated 07/09/2023, 06:31 AM

Seeing Machines: Underpinned By Road Transport Opportunity

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.