Eye-tracking opportunities

Seeing Machines (SM) announced 66% FY13 revenue growth, driven by strong demand from resources companies for its DSS (Driver State Sensor) fatigue and distraction monitoring product. The deal with Caterpillar, a blue-chip manufacturer of construction and mining equipment, sets in place a strong alliance to exploit the value in the mining haul truck market. We now expect SM’s focus on operator safety to shift to the much larger road transport sector. However, the biggest value in the group’s eye- and face-tracking IP is potentially in high volume consumer devices and SM has been talking to leading consumer electronics companies with a view to incorporating its IP into their products.

Investment case: First victory, bigger battles ahead

The Caterpillar alliance (May 2013) appears to have effectively tied up the mining haul truck end market for SM while also providing an avenue into adjacent verticals. It gives SM immediate access to a global market using Caterpillar’s network of dealerships and strong mining sector expertise. SM’s success in haul trucks has provided it with invaluable skills and experience to help it target the much larger vehicle fleet and OEM markets. SM is optimistic it can generate lucrative royalty revenues through the application of its IP in the consumer electronics space. We note a number of recent developments among the major device makers support the view that eye and face tracking could be an important part of the user interaction within broad electronic environments from PCs to TVs and automotive dashboards.

Results and forecasts: Conservative assumptions

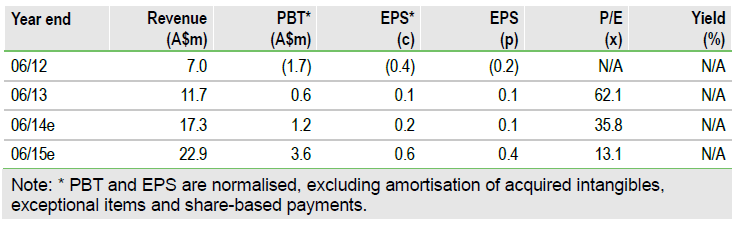

FY13 revenues jumped by 66% to A$11.7m as DSS revenue surged 84% to A$9.2m. The alliance with Caterpillar was late in the period and had no impact on the numbers. There was a backlog of 132 DSS units at the end of the financial year. SM has received orders for an additional 248 DSS units since the end of the period, meaning a total of 380 units already for FY14. We forecast revenues to jump 48% to A$17.3m in FY14, based on 800 DSS units shipping, rising to A$22.9m in FY15, with normalised PBT doubling to A$1.2m in FY14 and trebling to A$3.6m in FY15.

Valuation: Option value on a range of big bets

Based on our forecasts, which are predominantly driven from DSS sales, the stock trades on c 36x our FY14 EPS falling to 13x in FY15. We believe there are excellent opportunities to widen revenues, via third-party licensing arrangements, in the transport sector via OEM and in computer gaming/visualisation as well as in the vehicle fleet market and healthcare via the TrueField Analyzer eye testing device.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Seeing Machines

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.