Security stocks have been moving and many continue to surge. During such fast-moving cycles like this, traders often miss the opportunity for a good point of entry. Still, if you examine the price history in many of these stocks, you can often identify opportunities to buy along the way.

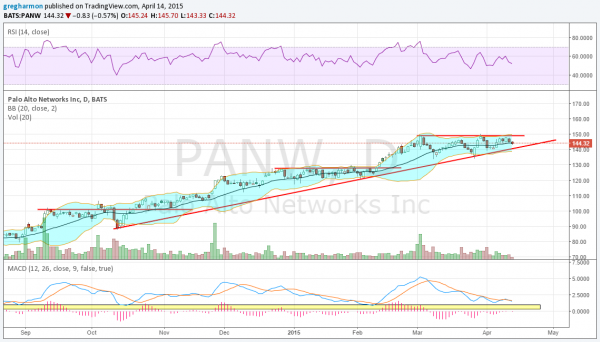

One of these opportunities is showing up now in Palo Alto Networks (NYSE:PANW). The stock has had a strong run higher as evidenced by the rising trend support since October. But it also shows several bounces off of resistance above since the beginning of March.

That happened in January through February as well, before its last leg higher. In fact that's typical of trending stocks. They pause to create a new equilibrium before a new round of buyers show up pushing it higher. For Palo Alto, this has happened near the support line, which it touched recently, and also when the Bollinger Bands® have tightened as they have now done

Notice also that the MACD has reset to near the level where a new leg higher has started in the past. All the while the RSI has held in the bullish zone. Looking at the latest consolidation would suggest a move to 163 on a break over 149 for a next leg higher.

Keep your eye on this one.