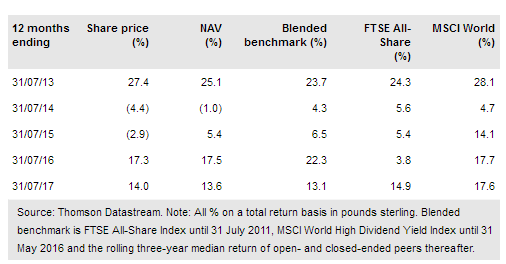

Securities Trust Of Scotland (LON:SESTS) aims to generate rising income and long-term capital growth from a relatively concentrated portfolio of 35 to 55 global equities. Since May 2016, the trust has been managed by Mark Whitehead, who heads up Martin Currie’s income team. A new unconstrained, high-conviction investment approach was adopted on 1 June 2016, with performance measured against a peer group comprising both closed- and open-ended funds. STS has outperformed the peer group since the change in investment strategy. The trust actively uses gearing and has a progressive dividend strategy; its current dividend yield is 3.5%.

Investment strategy: Improved fundamental approach

Since becoming manager of STS in May 2016, Whitehead has adopted a more rigorous fundamental approach to stock picking. While continuing to focus on quality companies with strong cash flows, which offer support for rising dividends and are trading below their assessed intrinsic value, the manager also undertakes credit and scenario analyses to understand the inherent risks in a company’s business model. In September 2016, STS increased its structural gearing. Net gearing of up to 20% of net assets is permitted; at end-July 2017 it was 11.0%.

To read the entire report Please click on the pdf File Below: