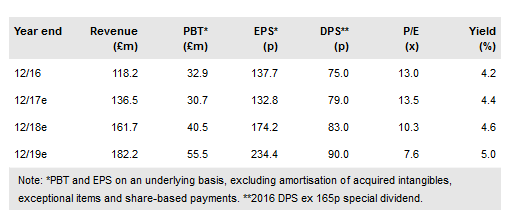

Secure Trust Bank Plc (LON:STBS) remains on track with both its shift towards a lower risk loan book and near-term trading. The move to lower risk assets has trimmed returns, but loan book growth continues apace and the benefits in terms of revenue and impairments should become clear in FY18 and FY19, years in which we expect earnings growth of over 30%.

Pre-close update

STB reported that Q4 trading was in line with management expectations and that FY17 results are likely to be similar to market estimates. The bank has continued the strategic repositioning of its loan book to a lower-risk profile through a move away from unsecured consumer, subprime motor and large prime central London housebuilding lending. As previously announced, the exit from unsecured personal lending was completed in December with the sale of the remaining portfolio, generating a profit of c £0.5m and net proceeds of c £36.6m. The level of impairments is not mentioned, indicating a stable situation ahead of the expected improvement as the benefits of the changes in the book flow through from FY18. Growth in the Retail, Motor, Mortgage and SME lending balances has continued in a controlled (but still brisk) manner.

To read the entire report Please click on the pdf File Below: