I think it’s really interesting to watch a sectoral public debt dynamic in step with certain market growth after local recession. Unfortunately, reviewing one is receiving too little attention in the media. For example, when we look briefly at the gold market, we note that debt investors' confidence and trust are being enhanced as far as gold prices stabilize.

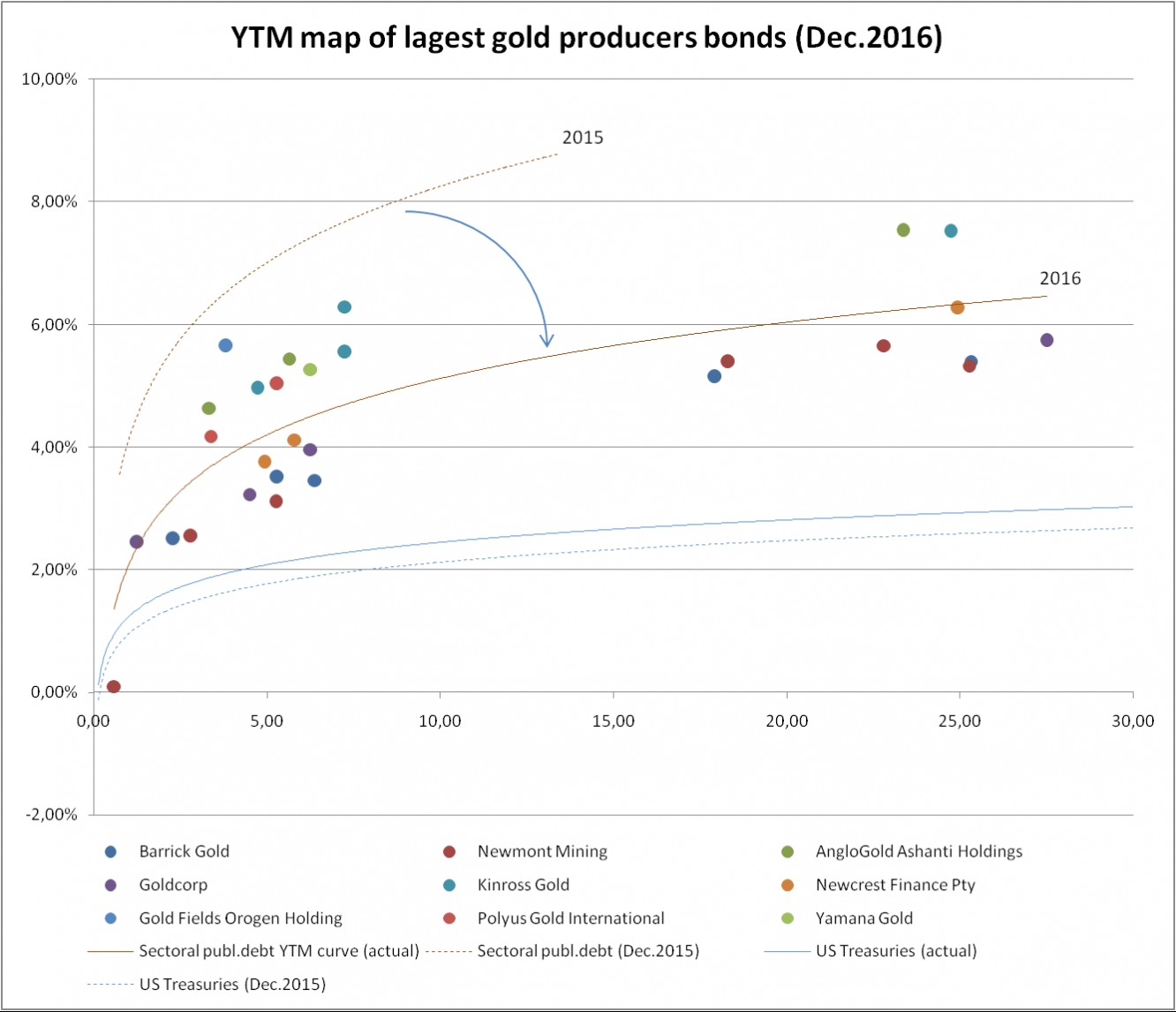

The graph below shows us how approximated the YTM curve of the world's largest gold producers bonds moved down during 2016.

This diagram consolidates massive points (duration/YTM) representing past and actual market circumstance of international bonds of nine public gold producers such as Barrick Gold Corporation (NYSE:ABX), Newmont Mining (NYSE:NEM), Anglogold Ashanti Ltd (NYSE:AU), etc. Together, these companies provide over 50% of yearly world gold supply.

Risk premium in gold producers' bond yields soared to barely believable heights by 2015. Depending on the duration, it ranged from 0,1 to 6,4 p.p. spread between sectoral and riskless (US Treasuries) curve. After the great fall of gold spot market in the spring of 2013, most traditional debt investors had become skeptical about industry bond perspectives.

It happened because such indicators as Debt to Equity, Debt to Market Cap and others had dramatically worsened against the background of the explosive growing of industrial borrowing in the previous period, when gold traded for as much as $1850 per ounce and companies aggressively stepped up mining.

As we can see, that risk premium has now declined in connection with spot market volatility falling. By contrast, Treasury curve itself moved up in so far as FOMC increased federal funds rate. The recovering of gold industry debt credibility is evident. Today, the environment of economic uncertainty fueled interest in traditional protective assets, such gold from investment funds.

As example, the latest World Gold Council Demand Trends Report shows that the investment component of gold demand begins to dominate over industrial again. Spot market growing can be expected in 2017, especially as prices obviously found a resistance area around $1050 per ounce. Therefore, sectoral risk premium for debt investors has the potential to further lowering.

Maybe in the near future, world gold producers' corporate bonds would offer possibilities for not only speculative, but long-term portfolio investment strategies. And anyway, it's always useful to understand the condition of some raw material sectoral public debt markets such as gold, oil and gas etc.