One of the more consistent "calendar effects" in markets is the so-called "Santa Rally" in global stock markets in the final weeks of December. Historically, equity markets have repeatedly shown a tendency to rally in the final five trading days of the year and combined with the January effect, which also tends to be positive for equities at the start of a new year, investors are typically cheerful around the holiday season.

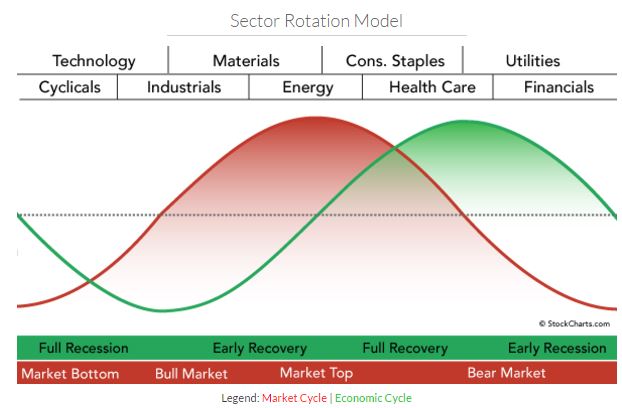

While we're still a few days from the traditional "Santa Rally" period, the types of stocks that have been leading markets higher suggest that equities should rally further through the holidays and into 2017. Sector rotation is the subset of technical analysis that involves evaluating the types of stocks that are performing well to help predict how the stock market as a whole will perform moving forward. Historically, economically-sensitive sectors like consumer cyclical, industrial and energy stocks tend to outperform the stock market in a healthy uptrend, while economically-insensitive sectors like utilities and health care stocks typically outperform when the market is at risk of a pullback.

John Murphy, the godfather of intermarket analysis, developed the idealized sector rotation model shown below:

Source: Stockcharts.com

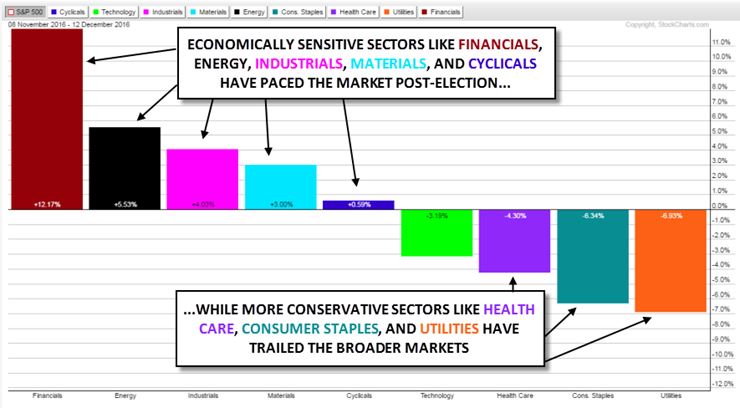

Sector rotation “works” because most fund managers must maintain a full allocation to stocks, regardless of their outlook for future performance. Therefore, the best way for them to outperform their benchmarks is to increase exposure to economically-sensitive sectors in bull markets and move cash into more conservative, stodgy stocks during bear markets. Based on the price action we've seen post-election, investors are positioning for continued strength in markets and the global economy:

Source: Stockcharts.com

Since November 8, the strongest-performing sectors generally correspond to the "bull market" stage of Murphy's idealized model. Conversely, the three worst-performing sectors are the types of conservative stocks that tend to outperform in bear markets, suggesting that the bull market remains healthy under the surface. While the "reason" for this move doesn't matter as much as the price action, it's logical to assume that investors are giving a thumbs up to the fiscal stimulus plans of President-Elect Trump and the incoming Republican-controlled Congress.

As a broader takeaway, we'd note that the strongest-performing sectors are starting to tilt toward the late-stage bull market area (industrials, materials and energy). This is typically when inflation starts to pick up in the real economy, so we'll be keeping a close eye on consumer prices heading into 2017; if the price of goods and services start to rise sharply, the Federal Reserve will have to raise interest rates far more aggressively than the "one-hike-per-year" pace that it established over the last 24 months.