Summary- More aggressive sectors are taking the lead in the one-week and one-month time frame.

- The economic fundamentals aren't supporting this view.

- If you want to follow the aggressive sector rally, make sure you've got downside risk protection in place.

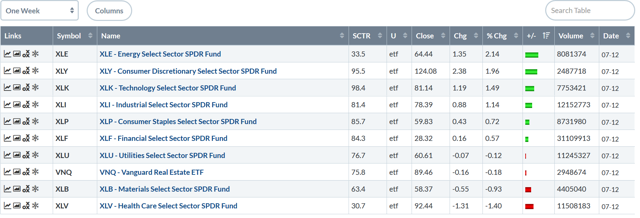

Let's begin where we always do - with the performance tables for the main market ETFs, starting with the one-week table:

This is a bullish table. Although only 6/10 sectors rose, three of the four decliners are defensive, implying a rotation from bearish to bullish investing. Energy topped the list. More than most, this sector has been at the mercy of geopolitical news over the last few years. However, its main product - oil - has been fairly cheap for a long time, leaving the sector in weak fundamental shape. Consumer discretionary, technology and industrials are numbers 2-4 in the table - another bullish development.

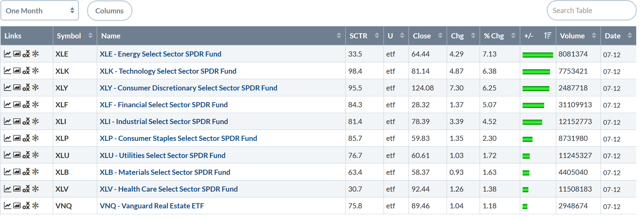

The one-month table is also bullish. All sectors rose. Defensive sectors are all in the lower half of the table. Technology, discretionary, and financials are numbers 2-4, with industrials rounding out the top five slots.

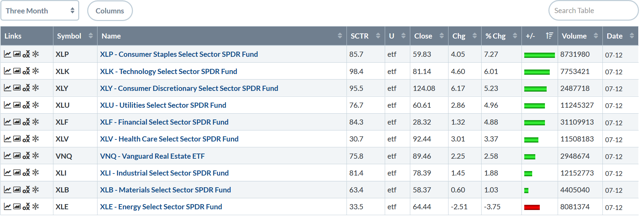

The three-month table is more defensive. The top four positions are evenly split between defensive and aggressive sectors. Staples and technology occupy the first two positions. Staples have rallied more than technology by 1.25%. Discretionary and utilities occupy positions three and four. Discretionary is the better performer but only by ~25 basis points.

At this point, I'm faced with an analytical dilemma. Aggressive sectors are now in the top positions of the one-week and one-month tables. Aggressive and defensive sectors are evenly matched on the three-month table. The technical data indicates investors should start switching from defensive to aggressive sectors. However, the fundamental data argues for a defensive posture. The following is from Chairman Powell's testimony this week (emphasis added):

Our baseline outlook is for economic growth to remain solid, labor markets to stay strong, and inflation to move back up over time to the Committee's 2 percent objective. However, uncertainties about the outlook have increased in recent months. In particular, economic momentum appears to have slowed in some major foreign economies, and that weakness could affect the U.S. economy. Moreover, a number of government policy issues have yet to be resolved, including trade developments, the federal debt ceiling, and Brexit. And there is a risk that weak inflation will be even more persistent than we currently anticipate.

Let's take these one at a time:

1.) In the East, China is confronted by two issues: the transition from an emerging growth economy to a more developed status (which means the pace of growth will naturally slow) and the trade war with the US. Both have negatively impacted its economy; industrial production is slowing, debt is rising, and exports are weaker. The latter has negatively impacted the entire Asian continent.

2.) The EU is clearly slowing as well. The main issue is a drop in German industrial output, which is itself the result of the negative trade environment. Add in the destabilizing nature of Brexit and you've got the recipe for weaker growth.

3.) Trade issues are buffeting the markets on a semi-regular basis. And the US has a quickly-approaching budget deadline, which last time ended in a government shutdown.

As a result, the Fed believes that risks have shifted to the downside.

The staff viewed the uncertainty around its projections for real GDP growth, the unemployment rate, and inflation as generally similar to the average of the past 20 years, although uncertainty was seen to have increased since the previous forecast. Moreover, the staff also judged that the risks to the forecast for real GDP growth had tilted to the downside, with a skew to the upside for the unemployment rate. The increased uncertainty and shift to downside risks around the projection reflected the staff's assessment that international trade tensions and foreign economic developments seemed more likely to move in directions that could have significant negative effects on the U.S. economy than to resolve more favorably than assumed. With the risks to the forecast for economic activity tilted to the downside, the risks to the inflation projection were also viewed as having a downward skew.

In other words, the Fed is now more dovish because it sees economic growth as more likely to slow than accelerate. Should the latter occur, the fundamental backdrop will suffer, hurting more aggressive sectors.

So, how should investors play this situation?

1.) Move into aggressive sectors at any pace but also limit downside risk using conditional market orders and/or options.

2.) Remain in defensive sectors but accept that you'll miss part of the rally.

There is no right or wrong answer. But you should know your own risk tolerance and act accordingly.