Sector ETF Week In Review For May 6-10Summary

- Sector performance over the last three months shows an aggressive, risk-on investment philosophy.

- Performance over the last month and week indicates a more defensive tone.

- The ratios of three defensive sectors (XLU, XLP, and XLV) relative to SPY is low, giving credence to the argument that traders will start to accumulate them.

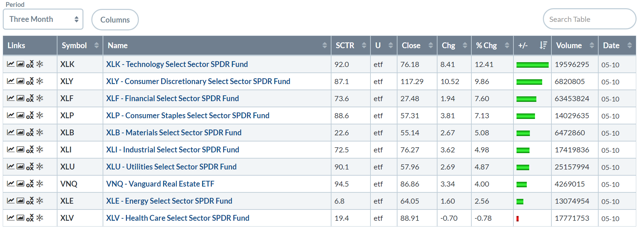

Let's begin with a look at the three-month performance table, which takes us back to mid-February.

This is a very bullish, risk-on performance table. Technology leads, rising 12.41; consumer discretionary is up 9.86. With the exception of healthcare (off marginally), all sectors are up.

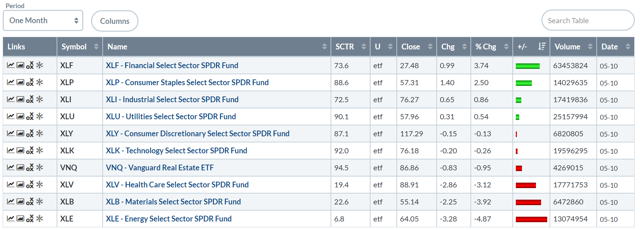

The orientation turns more defensive of the one-month table. Staples and utilities are the number two and four performers, respectively. Technology, which had led the market higher, is off modestly. Basic materials and energy are the top losers. Healthcare - which is normally a defensive sector - was off for political reasons.

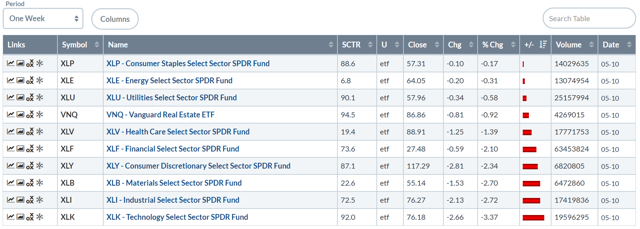

This week, the performance table is increasingly defensive. Staples, utilities, and real estate are the 1, 2, and 4 performers respectively. But they're still down. Technology is off 3.37% while industrials are down 2.72%.

Why the defensive turn? Part of the answer is a simple sector rotation. Aggressive sectors (technology and consumer discretionary) powered the market higher after last fall's sell-off. This was in the belief that the economy still had room to run - a solid conclusion based on the rising industrial production, low unemployment, rising incomes, and a still stimulative federal government stance. But now those sectors - along with large-cap indexes - are a bit stretched.

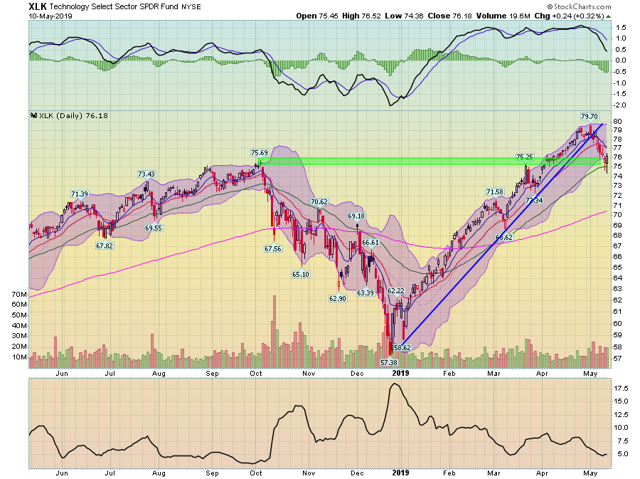

Technology has rallied from 57.38 to 79.7 - a nearly 40% rally. The MACD was pegged at high levels for the last three months indicating a very stretched valuation situation. Prices broke trend over the last few weeks and have now retreated to the 50-day EMA. The 10- and 20-day EMA have both turned lower with the 10-day EMA crossing below the 20.

The XLK/SPY ratio recently reached a five-year high, indicating a fairly extreme valuation relative to SPY.

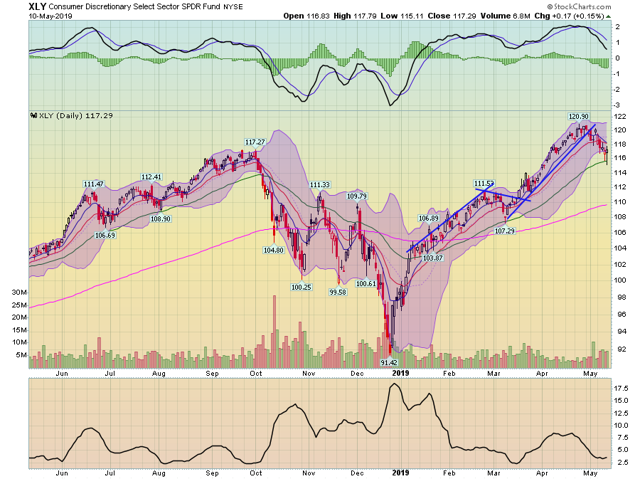

Consumer discretionary's rally occurred in two stages: the first lasted from late December to the end of February; the second started in early March and lasted until the end of April. The total rally gave the index a 32% gain. Prices broke the ETFs' uptrend at the end of last month and have descended to the 50-day EMA. The 10- and 20-day EMAs are moving lower and the 10-day EMA is about to cross below the 20-day EMA. The MACD is moving lower and has given a sell-signal.

The XLY/SPY ratio - like the XLK:SPY - recently hit a five-year high, indicating a very high level.

In comparison to the ratios of XLK and XLY to SPY, the three defensive sectors are weaker.

The XLP/SPY ratio rose from a 10-year low in the first half of last year. It fell a bit at the beginning of 2019, but appears to be bottoming.

The XLV/SPY ratio has been declining for the last three years, largely as more aggressive sectors have risen. But it has recently moved higher.

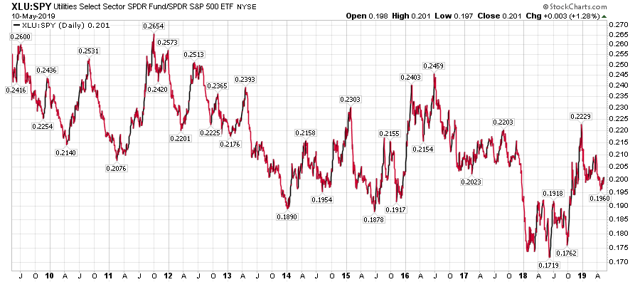

And the XLU/SPY ratio has been declining modestly for the last 10-years. It also has room to move higher.

The low level of the three defensive sectors relative to SPY does not mean they'll rally; they could move sideways or even dip lower. But it's also standard behavior for traders to move between sectors in a fairly logical way. With aggressive sectors' valuation high relative to SPY, it would only be natural for them to make the switch to a more defensive posture.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.