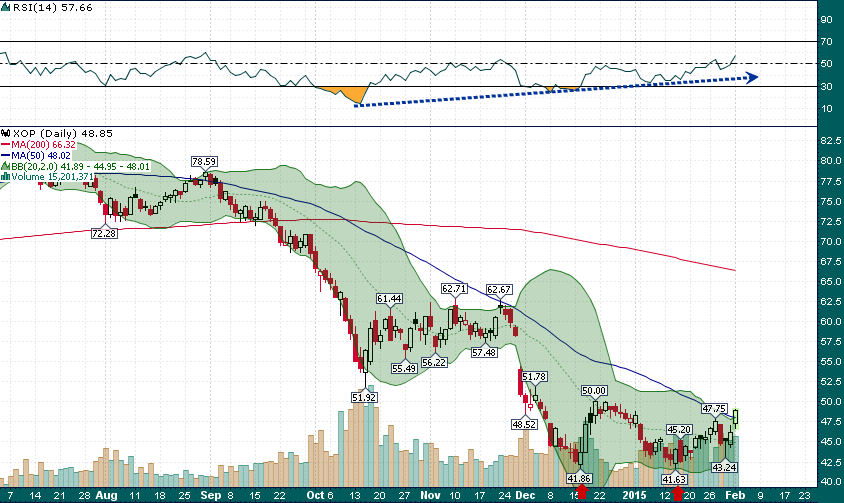

The SPDR S&P Oil & Gas Exploration & Production Index (NYSE:XOP) rose nearly 6% on the day yesterday, for its 2nd strongest single day performance since December 2011:

Yesterday also marked the first daily close above its 50-day simple moving average since August 29th for XOP. The volume and momentum divergences at each of the recent lows support the thesis that a double-bottom is now in place. The $50.00 level represents the next area of short-term resistance with the open gap up at $58.20 looking like a reasonable intermediate-term target for a rally.

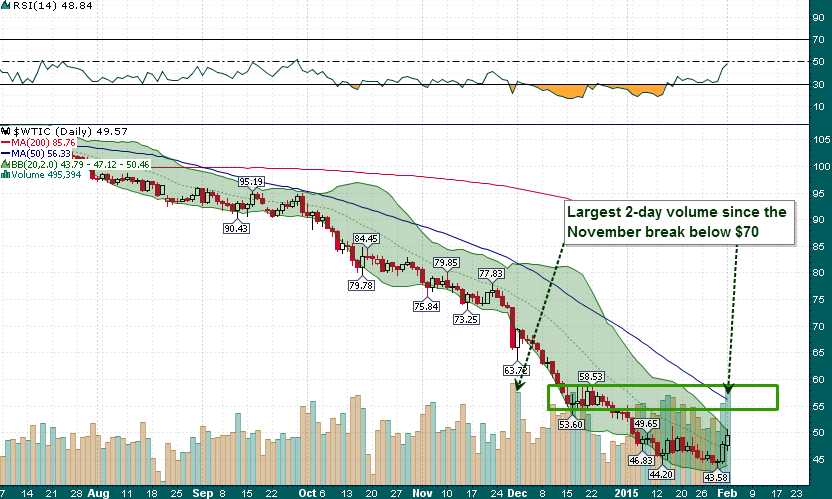

Meanwhile, since last Friday front month crude futures have staged a very significant rally which offers hope that a short-medium term bottom was reached last week:

The falling 50-day simple moving average and support/resistance from December offers a likely near-term upside target for this rally:

In summary, while the longer term technical picture remains challenging for crude oil there is ample reason to believe that the first significant counter-trend rally since the crude crash began in October is now underway.