The lack of structured data from the world’s economies meant that yesterday was a day when, once again, European politicians and their views were the main drivers of price action. Unfortunately that leads to a fairly volatile state of affairs with the euro once again in the crosshairs.

The Syriza party that came second in Sunday’s polls in Greece still has 48hrs to form a coalition but looks to be getting nowhere and, as such, another round of elections are now forecasted for June 17th. The problem is that the Greek government must have met certain budget requirements by June 30th or further bailout funding will not be forthcoming. It could be as early as 6 weeks from now that Greece has to fall on its sword.

Obviously those who have paid the cash over to Greece in the past are trying to make sure that any new government in Athens does not renege on previous deals. ECB board member Asmussen said that there is “ no alternative for Greece” other than implementing austerity while also saying that he “expects France to implement the fiscal pact unchanged”. That old saying of never assuming springs very readily to mind.

EURUSD has moved below 1.30 and has stayed there for the past 24hrs and hopes are that the 1.30-1.34 range that it has inhabited since December of last year is finally over. Likewise traders will be hoping that GBPEUR can base at levels around 1.2450 and establish a new range between there and 1.30 although that will be a tall order given the still fragile dynamics of the UK economy.

Likewise in GBPUSD, it has been very quiet given the machinations across the channel and we think traders wait on details from tomorrow’s Bank of England and Industrial Production numbers before pushing it one way or tother. It could be dragged lower through the day if EURUSD remains weak of course.

Spain will remain in focus as well today as fears over their banking system continue to rattle round the market. Spanish government yields have continued to track higher alongside Spanish default insurance while banking shares in particular had a rather hairy day yesterday.

The data calendar is once again quiet today.

Our latest Bank of England webinar is due tomorrow at 14.00. Join us for a run-down of sterling’s prospects over the next month as World First’s Chief Economist Jeremy Cook deciphers the impact of the morning’s Bank of England announcement. April was a terrible month, and not just for the weather. The UK is technically back in recession while the European situation continues to deteriorate. Meanwhile GBP comes close to multiyear highs versus the euro. We will answer the question on everyone’s lips: can it last? You can sign up here

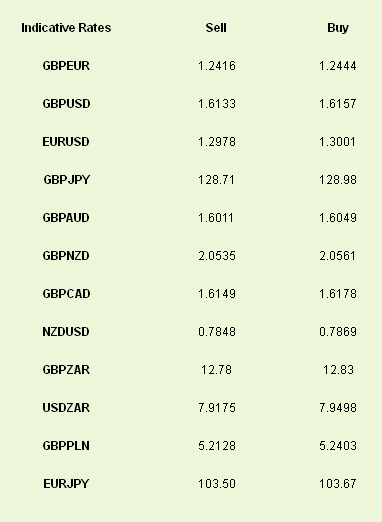

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Second Day Of Greek Negotiations Bring No Joy

Published 05/09/2012, 06:38 AM

Updated 07/09/2023, 06:31 AM

Second Day Of Greek Negotiations Bring No Joy

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.