SeaWorld Entertainment, Inc. (NYSE:SEAS) is a Florida-based theme park and entertainment company.

Generally, the second and the third quarters of each year are seasonally strong quarters for SeaWorld. Meanwhile, the company is making every possible effort to regain customers’ confidence.

Evidently, it continues to organize consumer events to drive attendance. Also, management is undertaking various initiatives to stabilize and deliver improved results in California, Texas and Florida markets. Extended hours at SeaWorld Parks, strategic season pass promotions and more such strategies are also expected to attract customers, thereby improving attendance.

However, SeaWorld’s total revenue per capita has been under pressure mostly due to lower attendance, especially from Latin American and the UK visitors. The company also believes that though Latin American visitation has been improving, it will take a long time to return to its previous glorious levels. Additionally, costs related to marketing and reputation campaigns as well as investments in new attractions might continue to hurt profits.

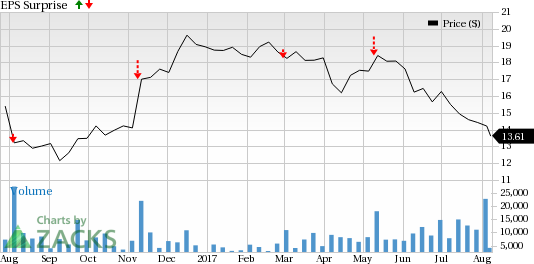

Investors should note that the consensus estimate for SEAS has been moving slightly downwards over the last 60 days. Meanwhile, SEAS’ has negative record of earnings surprises in recent quarters. In fact, the company posted negative earnings surprise in all of the last four quarters, with an average miss of 17.07%. Revenues posted positive surprises in just one of the trailing four quarters.

SEAS currently has a Zacks Rank #3 (Hold) but that could change following SeaWorld’s earnings report which was just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: SEAS beats on earnings. Our consensus earnings estimate called for earnings per share of 31 cents, and the company reported earnings of $1.09 per share. Investors should note that these figures take out stock option expenses.

Revenues: SEAS reported revenues of $373.8 million. This lagged our consensus estimate of $398.4 million.

Key Stats to Note: In second-quarter 2017, admissions and food, merchandise and other revenues inched up 0.4% and 1.1%, respectively.

Stock Price Impact: In-active in pre-market trading.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

SeaWorld Entertainment, Inc. (SEAS): Free Stock Analysis Report

Original post

Zacks Investment Research