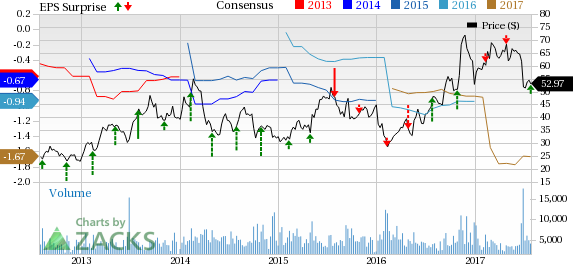

Seattle Genetics, Inc. (NASDAQ:SGEN) reported a loss of 39 cents per share for the second quarter of 2017, narrower than the Zacks Consensus Estimate of a loss of 43 cents but wider than the year-ago loss of 23 cents per share.

Revenues came in at $108.2 million, up 13.4% year over year, primarily on the back of strong sales of Adcetris. Revenues also beat the Zacks Consensus Estimate of $107.2 million.

Seattle Genetics’ share price has gained 0.3% year to date compared with the industry’s rise of 11.9% in the same period.

Quarter in Detail

Seattle Genetics’ top line comprises product revenues, collaboration and license agreement revenues and royalties.

The company’s only marketed product, Adcetris, generated revenues of $74.3 million, up 12.3% year over year.

Collaboration and license agreement revenues increased 7.5% to almost $21.5 million. Collaboration revenues included fees earned from the company’s agreement with Takeda Pharmaceutical Company Ltd. for Adcetris and other ADC collaborations.

Royalty revenues increased 34.7% year over year to $12.4 million attributable to international sales of Adcetris by Takeda Pharmaceutical Co. (OTC:TKPYY) .

Research and development (R&D) expenses were $114.4 million, up 33.7% year over year. Also, selling, general and administrative (SG&A) expenses increased 22.3% to $40.7 million. Costs were high primarily due to investment in vadastuximab talirine, enfortumab vedotin, Adcetris and other pipeline development.

2017 Outlook Update

The company raised its outlook for net sales of Adectris in the U.S. and Canada to the range of $290 million to $310 million (previously $280 million to $300 million).

Pipeline Update

Seattle Genetics continues to work on expanding Adcetris’ label further through three phase III trials. We note that the company reported positive data from ALCANZA phase III study recently and submitted a supplemental Biologics License Application (BLA) in June for including cutaneous T-cell lymphoma in its label.

The company announced top-line data in Jun 2017 from the phase III ECHELON-1 study (frontline classical Hodgkin lymphoma) on Adcetris showing a statistically significant improvement in modified progression-free survival (PFS). Seattle Generics and Takeda are planning to submit applications for regulatory approval in their territories.

Moreover, top-line data from the ECHELON-2 study (frontline CD30-expressing mature T-cell lymphoma) should be out in 2018. The company is also evaluating Adcetris in combination with Bristol-Myers Squibb’s (NYSE:BMY) Opdivo in relapsed/refractoryclassical Hodgkin lymphoma. Adcetris received a non-conditional approval in Canada for Hodgkin lymphoma with high risk of relapse.

In addition, the company expects to initiate a pivotal phase II study on enfortumab vedotin in patients with metastatic urothelial cancer patients in late 2017. Also, in the quarter, the diffuse large B-cell lymphoma candidate, polatuzumab vedotin, received PRIME designation in Europe, which is being evaluated in combination with Roche Holding (SIX:ROG) AG’s (OTC:RHHBY) Rituxan.

However, the company discontinued the phase III CASCADE study on vadastuximab talirinein frontline older patients with acute myeloid leukemia in Jun 2017 based on higher rates of death observed in the study.

Our Take

The company’s second-quarter loss was narrower than estimated and sales also beat expectations. With positive news announced from Adcetris studies, investors should focus on updates on Adcetris’ label expansion. The increase of the net sales guidance for Adcetris is also encouraging.

Seattle Genetics currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Roche Holding AG (RHHBY): Free Stock Analysis Report

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Seattle Genetics, Inc. (SGEN): Free Stock Analysis Report

Original post