In a recent article I wrote about a potential seasonal speculation in soybeans. A similar potential opportunity also exists in the corn market. Like beans, the corn market is a highly cyclical market. This is in large part due to the planting and growing season (as explained here). This article is about a “seasonal/cyclical” speculative play using options on Teucrium Corn Fund (NYSE:CORN).

There are two key caveats:

*The trade highlighted is NOT a “recommendation”, only an example of how to speculate on a potential move using options in order to achieve limited risk and unlimited profit potential.

*Options on ticker CORN are very thinly traded. So, any investor who might choose to wade in needs to be aware that they may need to consider using a limit order in order to avoid significant slippage.

The Setup

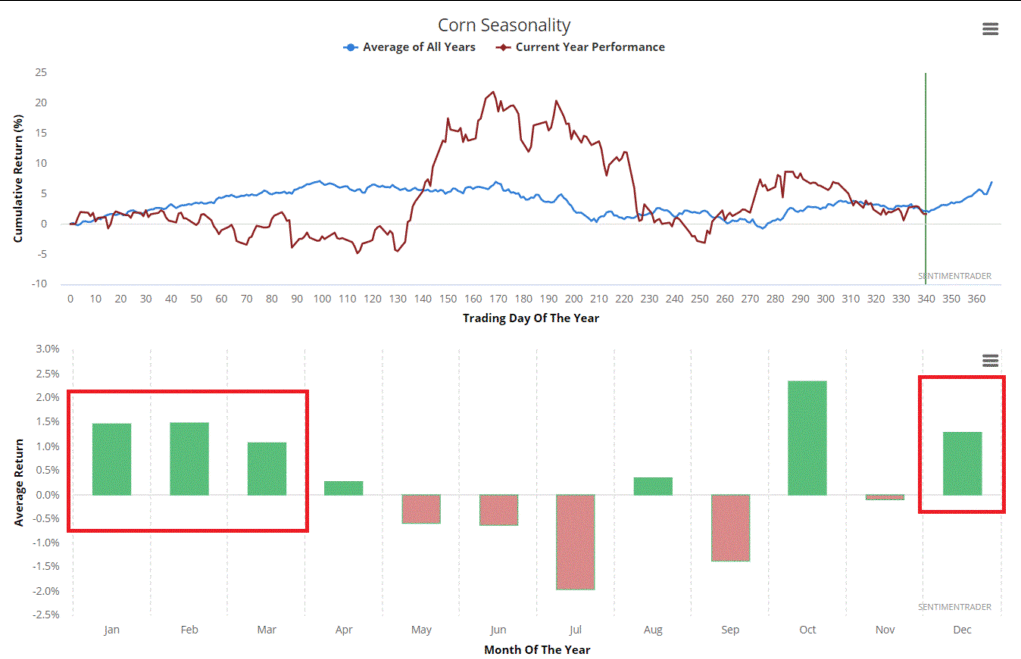

Figure 1 displays the annual seasonal trend for corn according to sentimentrader.com.

Courtesy: sentimentrader.com

It is critical to understand that this is the “average” for what has happened in the past and should in no way be viewed as a “roadmap”. Still, the point is pretty clear – late in the year through the month of April tends to be the “bullish” time for corn.

Figure 2 displays that bullish sentiment for corn was recently quite low. While this by no means guarantees a rally, historically this often a signal that downside risk may be relatively low.

Figure 2 – Bullish Sentiment for Corn: Courtesy: sentimentrader.com

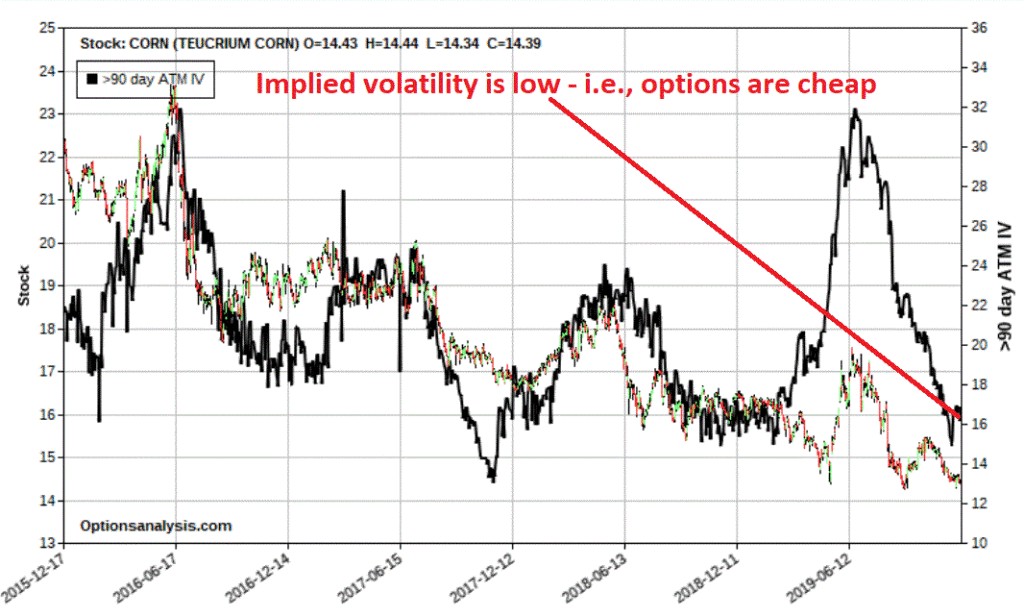

Figure 3 tells us that options on the ETF ticker CORN (which tracks the price of corn futures) are presently cheap – i.e., implied option volatility (the black line in Figure 4) is extremely low. This tells us that little option premium is built into the prices of CORN options.

Courtesy OptionsAnalysis.com

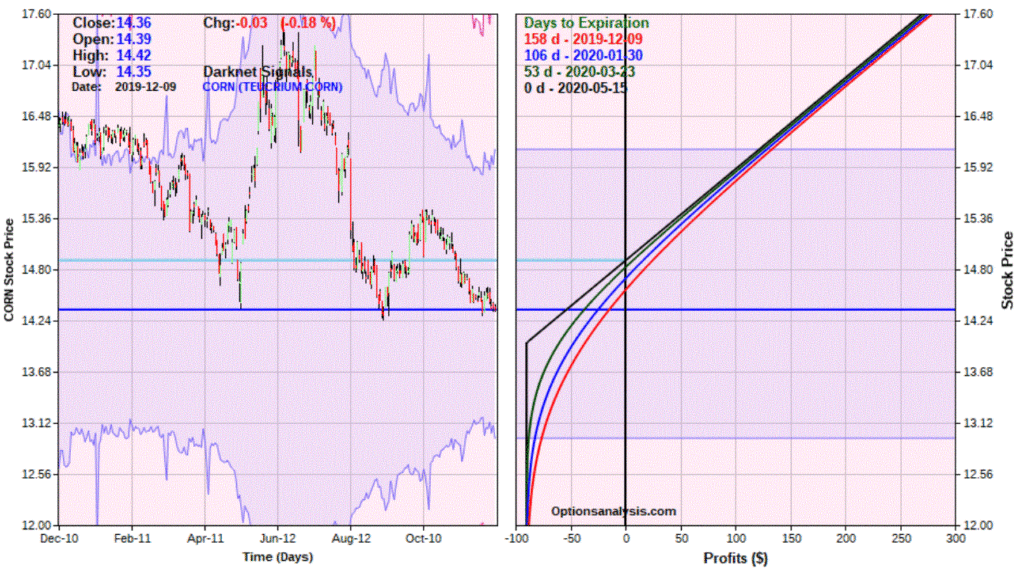

Figures 4 and 5 display the particulars for one possible speculative play designed to make money if CORN does in fact move higher sometime between now and the end of April 2020.

Courtesy OptionsAnalysis.com

Courtesy OptionsAnalysis.com

So, is this really a good idea? I am not actually saying that it is. As always with this blog, this is not a “recommendation”, only an “example.” Let’s hit the most important points to consider with this example.

A few things to note:

*This position qualifies as “serious bottom picking” – which is generally considered to be a loser’s bet. However, the mitigating factor here is that we are risking only $90 (or possibly less if a limit order is used to enter) per contract. And position sizing should be kept on the small size. For example, a trader with $25,000 might buy a 3-lot and risk 1.1% of their trading capital.

*If CORN does NOT advance at anytime in the next 5 months this trade is certain to lose money.

*If CORN were to rally to its it’s 2019 high of $17.55 a share, this position would roughly triple in value.

So, the bottom-line questions for a trader in considering this trade are:

*Are you OK with risking $90 per contract on the hopes that corn will rise between now and the end of April 2020?

*If you do enter the trade, how many contracts will you buy/what percentage of your trading capital will you risk?

*If CORN fails to rally will you simply hold the options or will you consider exiting early if – for example – a key support level is broken?

*If CORN does advance at what share price or option trade profit level will you, a) take a profit or b) adjust the trade?

Buying inexpensive call options is something of a siren song for a lot of traders and can lead to mistakes. But sometimes it can make a lot of sense as long as you:

*Put as many factors in your favor

*Don’t bet the ranch

*Formulate and follow a trade plan