Seagate Technology Plc (NASDAQ:STX) renewed an existing strategic cooperation agreement with Chinese search-giant Baidu Inc. (NASDAQ:BIDU) . Seagate’s shares have increased 0.57% in pre-market trading following the news on Sep 18.

According to the latest pact, Baidu will give preference to Seagate’s storage products and solutions over other providers. In return, the company will get advanced access to Seagate’s products, services and support. Moreover, the companies will collaborate to design customized systems for the Chinese company.

We note that the renewed deal is particularly beneficial for Seagate as it will improve its competitive position in China. The company blamed sluggish China CSP demand along with lackluster demand for OEM nearline and mission critical solutions as well as weakness in Cloud storage Systems business behind its fourth-quarter debacle.

Notably, revenues declined 9.3% to $2.41 billion and missed the Zacks Consensus Estimate of $2.55 billion in the quarter. Moreover, non-GAAP earnings declined 5.8% to 65 cents, which also lagged the Zacks Consensus Estimate by a massive 34 cents.

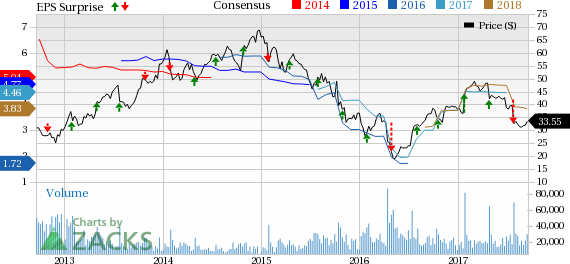

Seagate has lost 12.1% of its value year to date versus the 14.2% growth of its industry.

Partnership to Boost Big Data Footprint

The deal will help both Seagate and Baidu address the challenges of ongoing data explosion.

Market research firm IDC forecasts that by 2025, the global datasphere will grow to 163 zettabytes (trillion gigabytes), which is ten times the 16.1 zettabytes (ZB) of data generated in 2016. More importantly, almost 20% of this will be critical to daily lives and nearly 10% of that will be hypercritical.

This massive volume of data presents significant growth opportunity for enterprises. However, effective storage is absolutely necessary to properly harness this data. This presents significant growth opportunity for Seagate in the long term.

We also note that Baidu has been a long-time user of Seagate’s enterprise drives in its data center and public cloud platform. The company is considered a pioneer of Artificial Intelligence (AI) techniques along with Tencent and Alibaba (NYSE:BABA) in China. Moreover, the search giant has also set up Big Data lab in Beijing, which focuses on large-scale machine learning algorithms.

We believe the renewal of the deal will boost Seagate’s brand image and recognition in China, which will help it to penetrate this rapidly-growing market going forward.

Expanding Portfolio Key Catalyst

Seagate has been losing hard-disk drive (HDD) market share amid significant competition from Western Digital Corporation (NASDAQ:WDC) . Despite a number of acquisitions, the company also doesn’t have significant presence in the flash memory market.

Nevertheless, we expect Seagate’s expanding portfolio to be a game changer going forward. At the 2017 Flash Memory Summit (FMS), the company announced enhanced versions of two flash technologies to boost performance and capacity for mixed data center workloads.

These solid-state drives (SSD) effectively address the growing needs of demanding enterprise applications like data mining, weather modeling and online transaction processing, where fast data access and processing power are of utmost priority.

Although ramping of its 10 terabyte (TB) helium (nearline) drives have been disappointing, Seagate now expects to ship approximately 1 million 10 TB units in the current quarter. Moreover, management noted that the 12 TB product (shipped in June) has received excellent customer feedback.

Seagate now expects to achieve approximately 50% of the exabyte share within the 10TB and 12TB market by the end of 2017.

Currently, Seagate has a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Western Digital Corporation (WDC): Free Stock Analysis Report

Seagate Technology PLC (STX): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Baidu, Inc. (BIDU): Free Stock Analysis Report

Original post

Zacks Investment Research