Seagate Technology plc (NASDAQ:STX) reported disappointing fourth-quarter fiscal 2017 results. Both non-GAAP earnings of 65 cents per share and revenues of $2.41 billion missed the Zacks Consensus Estimate of 99 cents and $2.55 billion, respectively.

Seagate also announced the appointment of Dave Mosley as Chief Executive Officer (CEO) and instated current CEO Steve Luczo as the Executive Chairman effective Oct 1, 2017.

Non-GAAP earnings plunged 41% on a sequential basis, primarily due to 10% decline in revenues. On a year-over-year basis revenues fell 9.3%, which reflects intense competition in the Hard Drive Disk (HDD) market from the likes of Western Digital (NASDAQ:WDC) .

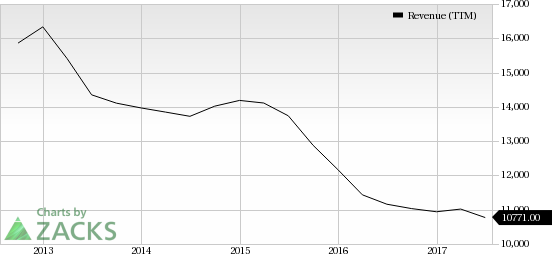

Seagate reported fiscal 2017 revenues of $10.77 billion, down 3.5% over fiscal 2016. The company generated approximately $1.9 billion in cash flow from operations and returned 53% of that to shareholders in cash dividends worth $561 million and share repurchases worth $460 million.

Shares were down more than 18% in pre-market trading following the results. Seagate’s stock has gained 4.2% year to date, substantially underperforming the 22.9% rally of the industry it belongs to.

Quarter Details

Seagate reported non-GAAP gross margin of 28.9%, which contracted 250 basis points (bps) on a sequential basis.

Operating expenses (prior to amortization & restructuring charges), as a percentage of revenues, increased 40 bps sequentially to 17.7%. Product development, as a percentage of revenues, decreased 10 bps, which was fully offset by a 60-bps increase in marketing and administrative expenses sequentially.

Seagate exited the quarter with cash and cash equivalents of $2.54 billion, as compared with $3.02 billion in the previous quarter. Long-term debt was $5.02 billion, as compared with $5.07 billion in the preceeding quarter.

Zacks Rank & Key Picks

We believe that declining PC shipment – per latest data from Gartner and IDC – doesn’t bode well for Seagate. The company is the second largest manufacturer of HDDs in the U.S., which are extensively used in PCs and Seagate derives the bulk of revenues from these devices.

Currently, Seagate carries a Zacks Rank #3 (Hold). Infineon Technologies (OTC:IFNNY) and Applied Optoelectronics (NASDAQ:AAOI) are two top-ranked stocks worth consideruing in the broader sector. Both of them sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Infineon and Applied Optoelectronics are expected to report earnings results on Aug 1 and Aug 3, respectively.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

Western Digital Corporation (WDC): Free Stock Analysis Report

Seagate Technology PLC (STX): Free Stock Analysis Report

Infineon Technologies AG (IFNNY): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Original post

Zacks Investment Research