Delivery of strategic objective

Seaenergy Plc (LONDON:SEAE) has achieved its strategic objective of reporting operating profit before exceptional items. With the key R2S VAM business continuing to grow strongly and a management team focused increasingly on developing this business, we expect to see further growth in FY15 and FY16. At current levels the market appears not to be valuing this growth.

FY14 marked by move into operating profit

SeaEnergy reported an operating profit of £151k (pre non-recurring items) for FY14, achieving its target of moving the business into profitability before exceptionals. R2S VAM and Consulting both traded profitably for the year and Marine achieved a profit in H2. R2S VAM generates over 90% of group profits and continues to post strong y-o-y growth (revenues +12%, operating profit +20%). An impairment charge (£2.3m) to the value of SeaEnergy’s holding in Lansdowne Oil & Gas, SeaEnergy’s share of losses at its associate company and a further £150k charge for restructuring, pushed the business overall into a loss of £2.5m. The payment, largely in cash, of the final part of the R2SVAM earn-out (£4.3m) resulted in SeaEnergy recording a small net debt position at the year-end (£22k).

Outlook of improving profitability and cash flow

We expect further growth at R2S in FY15. Despite a lower oil price, SeaEnergy has, so far, experienced few project deferrals and R2S posted a strong H2. The cost-saving aspect of R2S’s technology should enable it to withstand the worst impact of reduced oil industry capex budgets and we expect a 14% rise in operating profits in FY15. We anticipate the downturn in the oil sector to have a greater impact on the Consulting division and we expect flat profitability. The decision not to proceed with the provision of capital intensive offshore wind farm support vessels will leave the Marine division with a profitable ship management business (Edison FY15e operating profit of £650k) and free up management’s time to focus on the fast-growing, high-margin, high-return R2S VAM. In the absence of acquisitions we expect positive cash flow in FY15 and FY16.

Valuation: Growth not reflected in valuation

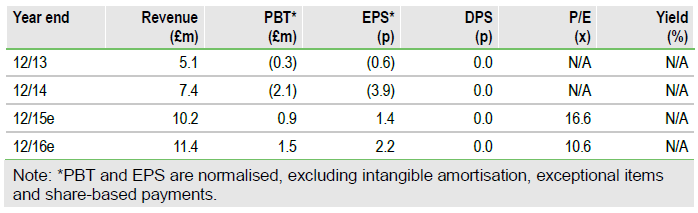

SeaEnergy is trading on an FY15 P/E of 16.6x vs 16.5x for the FTSE All-Share, despite offering far superior forecast EPS growth (FY16e vs FY15e). SeaEnergy’s FY16e EV/EBITDA multiple of c 7x stands at a discount to the market (c 8x).

To Read the Entire Report Please Click on the pdf File Below