For the 24 hours to 23:00 GMT, AUD strengthened 0.19% against the USD to close at 0.8928.

LME Copper prices declined 0.2% or $11.0/MT to $7096.0/MT. Aluminium prices rose 1.3% or $21.5/MT to $1663.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.8965, with the AUD trading 0.41% higher from yesterday’s close, after data showed that, on a seasonally adjusted basis, retail sales in Australia rose 0.5% (MoM) in December, compared to a 0.7% (MoM) increase seen in the preceding month. Adding to the positive sentiment was another report that showed Australia’s trade surplus unexpectedly widened to A$468 million in December, compared to a surplus of A$83 million recorded in the previous month.

Separately, the National Australia Bank (NAB) reported that, on a quarterly basis, its business confidence indicator advanced to a reading of 8.0 in the fourth quarter, form a level of 5.0 registered in the preceding quarter.

Also earlier today, Australian Treasurer, Joe Hockey, warned that the structural position of Australia’s budget is now unsustainable, suggesting that the government should restore the nation’s fiscal position to a sustainable long-term path.

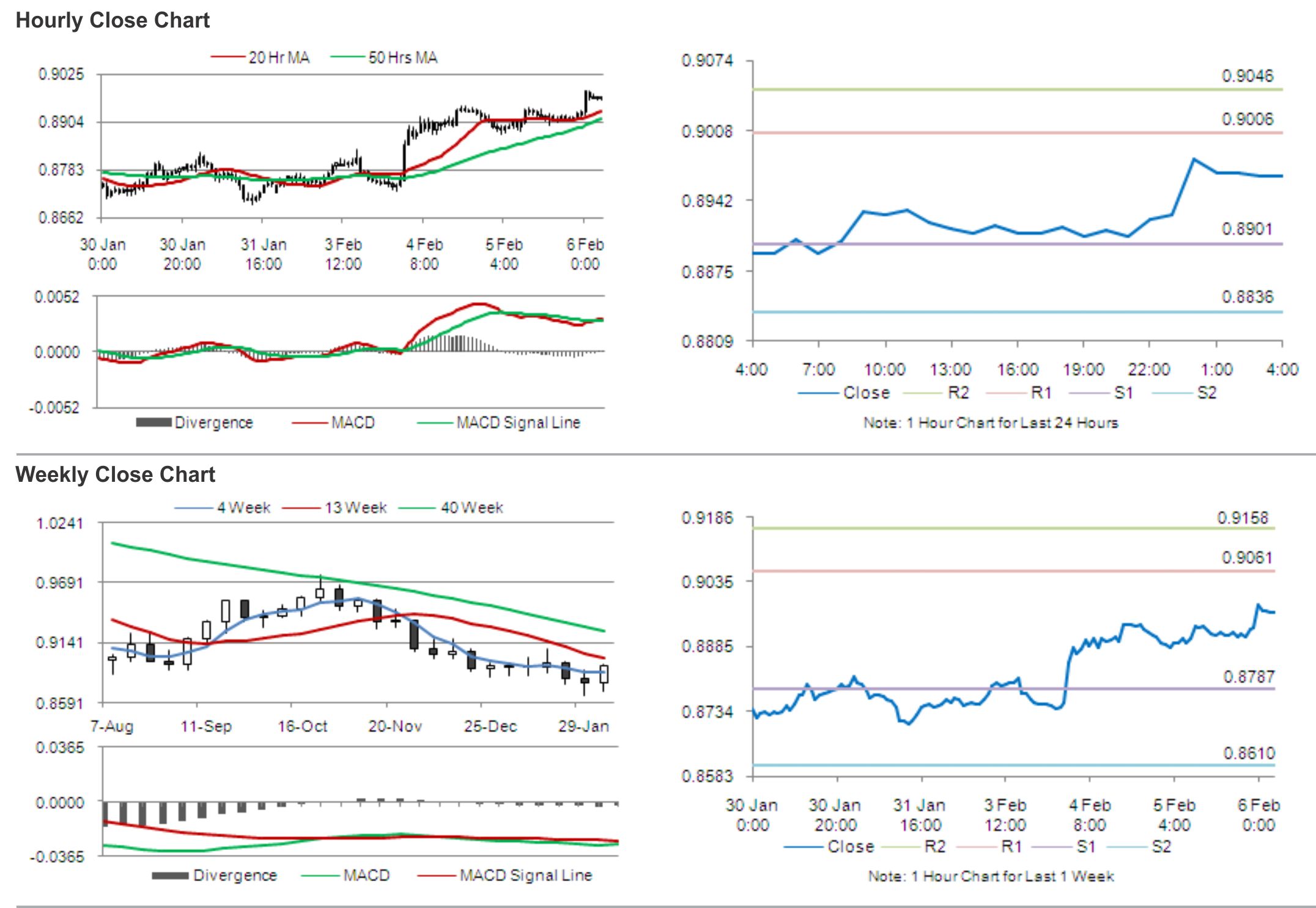

The pair is expected to find support at 0.8901, and a fall through could take it to the next support level of 0.8836. The pair is expected to find its first resistance at 0.9006, and a rise through could take it to the next resistance level of 0.9046.

Traders would keep a tab on Australia’s AiG performance of construction index due to be released later today, while tomorrow’s Reserve Bank of Australia (RBA) Monetary Policy Statement would help assess the economic growth in the nation.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.