SDX Energy Inc (LON:SDX) has announced a £10m equity raise targeting an accelerated exploration and development well programme (in addition to its existing aggressive work programme). Two wells in Egypt will target the largest prospects close to South Disouq and aim to de-risk up to 150bcf (P50) of the prospective resources, and enable SDX to right-size the production facilities for the most economic development.

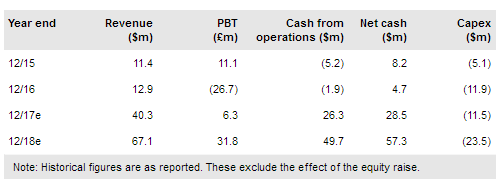

In Morocco, two further wells will target around 2bcf of gas that can be quickly developed and sold at high netback prices. As such, the £10m (65% underwritten by the largest shareholder) will go entirely to growth projects that have high IRRs/NPVs, and speed up the exploitation of its development resources. The company remains in strong financial health, but the additional capital will add further momentum to realising value from the portfolio. We will update our forecasts and valuation in coming days, which currently stand at 55p/share (core NAV) and 67p/share (RENAV).

In Egypt, the discovery of South Disouq warrants more urgent follow-up. Two large prospects nearby (Bragg and Kelvin) are targeted and the results will determine the required facility and pipeline capacities for the development of the area. This is in addition to a planned development well campaign expanding on SD-1X which aims to prove up resources to the flanks of the initial discovery where the company believes the reservoir thickens and upside could be unlocked.

To read the entire report please click on the pdf file below: