SDX Energy Inc (LON:SDX) is a North Africa-focused E&P with production in Egypt and Morocco. The company benefits from strong cash flow generation from its oil production (Egypt) and high value gas production in Morocco, which is being re-invested to increase production markedly in H217. The company added to its portfolio in early 2017 and continues to seek other opportunities. We have adjusted our valuation, which sees the core NAV increase to 55p/share (from 40p/share) but RENAV fall to 67p/share. With further success in exploration at South Disouq this could grow further.

Aggressive programme by year end

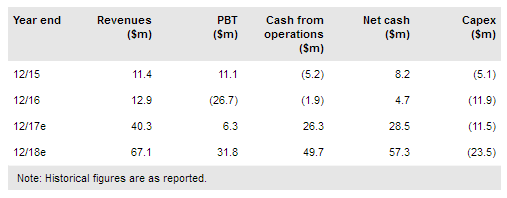

SDX is planning to undertake a significant work programme in H217. Workovers and pump replacements will target an increase in production at NW Gemsa, while electrical submersible pump (ESP) replacements, waterflood and increased water handling capacity at Meseda could more than double existing production (3.4m/d) by year end. Additionally, the company is planning a seven-well campaign in Morocco, focused mainly on increasing reserves at Sebou and discovering new reserves at Lalla Mimouna to increase in production to a supply-constrained market. Finally, the success at South Disouq is anticipated to be followed up, targeting first gas in early 2018. Although this means material capex in H217, it should also produce a meaningful increase in cash flow in 2018, giving high returns on its investment.

To read the entire report Please click on the pdf File Below: